Reported by

A Maltese court sentenced Robert Agius to life in prison last week for supplying military-grade explosives to hitmen who murdered journalist Daphne Caruana Galizia, bringing to an end a six-week trial that has gripped this Mediterranean island country.

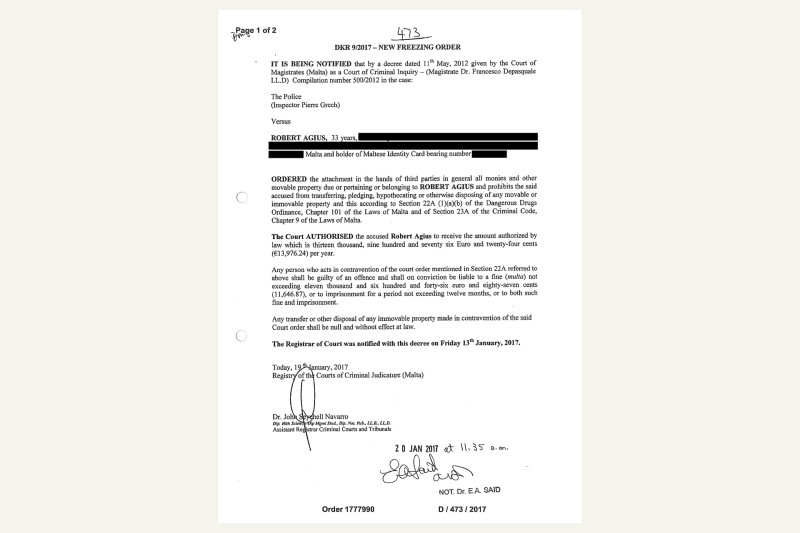

The case against Agius began in 2021, after one of the hitmen, who triggered the car bomb that killed Caruana Galizia, reportedly took a plea deal and named Agius as a supplier of the explosives, along with an associate. He was arrested the same day, and a Maltese court soon froze his assets, issuing an order that was supposed to prohibit him from transferring funds or selling properties, and limiting his income to just under 14,000 euros ($17,000) per year. It was the third time Agius had been hit with an asset freeze since 2013.

But the freezes were broadly worded, and only referred to Agius personally — the court did not name specific companies or assets linked to him that should be frozen. Now, reporters from OCCRP, Times of Malta, Amphora Media, and IrpiMedia have learned that a firm he co-owned and another registered by his wife were able to buy and sell properties worth millions of euros during this period, including purchasing a 470,000-euro villa called “Le Chateau.”

These transfers occurred even as Maltese police investigated him for his role in the murder of Caruana Galizia, and for allegedly laundering drug proceeds through real estate. (Agius has never been charged with money laundering. Neither he nor his wife responded to requests for comment. Agius and his wife's assets are legally separate, according to the terms of a 2010 prenuptial agreement.)

Journalist Daphne Caruana Galizia's memorial in Valletta, Malta.

The fact that companies owned by Agius and his immediate family members were able to so easily move assets points to possible shortcomings in Malta’s enforcement of financial crime regulations, experts said.

“Shifting assets around family members is a common typology that we’ve seen in sanctions evasion and in attempts to conceal assets,” said Kathryn Westmore, who leads work on financial crime policy for the British think tank Royal United Services Institute (RUSI) .

Between 2021 and 2022, Malta was “greylisted” by the intergovernmental financial crime watchdog Financial Action Task Force. Westmore said the action suggested the country at that time “didn’t have the legal framework and effective implementation” to effectively police financial crime risks.

Manfred Galdes, the former head of Malta’s Financial Intelligence Unit, said that when freezing orders were not accompanied by financial investigations to trace specific assets, they were far less effective.

Any failure to trace and target assets means that there would be “lots of gaps for people to transfer assets to companies,” he said.

“The Asset Freeze Was Not Hugely Effective”

Agius’s arrest in 2021 wasn’t the first time he had been in trouble with the law — or subject to an asset freeze. He also received one in 2013 after being charged with cigarette smuggling, and another in 2017, connected to charges in a heroin trafficking case.

The most recent court order freezing Robert Agius's assets, from January 2017.

He was eventually acquitted in both cases, but the three court orders meant that Agius has been subject to personal asset freezes since 2013, apart from a seven-month period in 2020 and 2021.

In 2017, six months after the second asset freeze was imposed, Agius’s wife Denise set up a company called Ages Investments Limited. It went on to accumulate almost 2 million euros’ worth of assets in a span of a few years.

Between 2019 and 2021 the company purchased eight properties worth 1.7 million euros. Over the next few years, it also sold four apartments worth almost 1.1 million euros.

One of the properties the company purchased was Le Chateau, which Agius used as his personal residence, according to court records. The home was purchased in September 2019 for 470,000 euros from J. Zammit Estates Ltd, a company belonging to car dealer turned financier James Zammit.

Agius's Car Salesman Associate

Ages Investments also raised significant financing from companies owned by Zammit during this period, and appears to have used the money to go on a spending spree.

To purchase Le Chateau, Ages Investments borrowed 270,000 euros interest-free from J. Zammit Estates — a debt that was settled in August 2020, when Zammit’s other company, Finance House PLC, loaned Ages Investments another 1.3 million euros. (This second loan was issued a week after Agius’s second freeze order was lifted, and seven months before the third one was imposed.)

The terms of the loan listed expenses it would be used for, including the purchase of a luxury sports car worth 190,000 euros, repayment of a 330,000-euro debt, payment toward several real estate acquisitions worth 250,000 euros, and 250,000 euros to Agius’s brother for his penthouse.

An Ages Investments financial statement also showed a 406,000-euro shareholder loan, despite the fact that Denise Agius — the company’s only shareholder — has no obvious source of independent wealth.

Denise Agius.

Police and intelligence records obtained by reporters indicate she has worked as a hairdresser, making 50 euros a day, and that prior to registering Ages Investments she told a bank she was a bingo hall cashier or receptionist. A police file also indicated that Denise worked for a TV production company, We Media Limited. According to company transactions viewed by reporters, she was paid a total of 207,000 euros between from 2016 and 2021 in consulting fees and wages. We Media did not respond to a request for comment.

According to notarized property records, the collateral for the second loan from Zammit’s company was a property called Kingstone Garage, which was legally managed by Robert’s mother. There is no record that this loan was ever repaid.

While Robert Agius was subject to the first asset freeze from 2013, a company he co-owned with his brother and mother was also able to sell a property called Vella Farm in 2014 for 700,000 euros after acquiring it in 2008 for around 466,000 euros.

Records show Vella Farm was used as collateral for bank and personal loans continuously between 2010 and 2014.

“The loans and spending indicate the asset freeze was not hugely effective, and [Agius] seems to have found a way to maintain his lifestyle while technically having his assets frozen,” said RUSI’s Westmore, who also said the transactions should have attracted the scrutiny of banking compliance teams.

“If you are banking [Ages Investments] you need to ask what are the purposes of the loans and transactions, what is their commercial rationale. If you’re a bank that has that company as a client, you would hope that your [client] onboarding process would pick up the links to someone under an asset freeze, and then the transactions would merit further investigation. You need to check someone’s made sure they have a legitimate purpose,” she said.

A "Well-Connected" Family

Robert Agius’s brother Adrian was also convicted this month as part of the same case, for the murder of a Maltese lawyer who was gunned down in 2015. Before the trial began, the brothers had argued in court that any reference to their family’s nickname Tal-Maksar in the indictment could be prejudicial. The name carried so much notoriety in Malta that the judge granted their request.

Adrian Agius.

Their father, Raymond Agius, was investigated by Maltese police for a decade for suspected smuggling, according to statements made in court in 2020 by the former head of Malta police’s Economic Crimes Unit, Ian Abdilla. Raymond was never charged, however, and the brothers inherited his assets in 2008 after he was shot twice in the head in a local bar.

In his testimony, Abdilla described how investigations involving members of the Agius family had repeatedly fallen apart because they were “well connected” with police, customs, and “politicians on both sides.”

A 2018 internal report by the EU’s law enforcement agency Europol described the brothers as “the main criminals managing the distribution of large cocaine and heroin loads in Malta” and alleged that they headed an organized crime group with ties to criminals in the U.K., the Netherlands, Italy, Albania, and Libya, though the report did not set out evidence for these claims.(The brothers were never charged with an organized crime-related offense.)

In July 2013, Maltese police intercepted a boat carrying over a million contraband cigarettes worth tens of thousands of euros. A criminal court magistrate issued an immediate asset freeze order on five suspects, including Robert Agius, who was charged with cigarette smuggling, but all were acquitted in 2018 due to insufficient evidence.

And in 2012, Maltese police intercepted a woman arriving in Malta on a flight from Cairo, carrying two plastic blocks apparently filled with heroin. The woman told police that she had agreed to smuggle the drug into Malta for Robert Agius in exchange for payment.

In a controlled delivery filmed by police, the woman pushed a paper bag with decoy wooden slabs inside into the window of a Peugeot, and accepted cash from a passenger. Police stopped the vehicle and arrested Agius, later charging him with conspiracy to traffic heroin.

A judge ordered an asset freeze in January 2017, prohibiting him from transferring assets for a second time. (The court told reporters in an email that the “action was taken in light of further developments in the case.”) But the freeze order was lifted in 2020, following an acquittal due to lack of evidence after the woman refused to testify.