Reported by

Two Paraguayan banks publicly committed to green initiatives loaned $36 million to companies belonging to a Brazilian agribusinessman with a history of committing environmental crime in a once richly forested part of eastern Paraguay, documents obtained by OCCRP and Dutch newspaper Het Financieele Dagblad reveal.

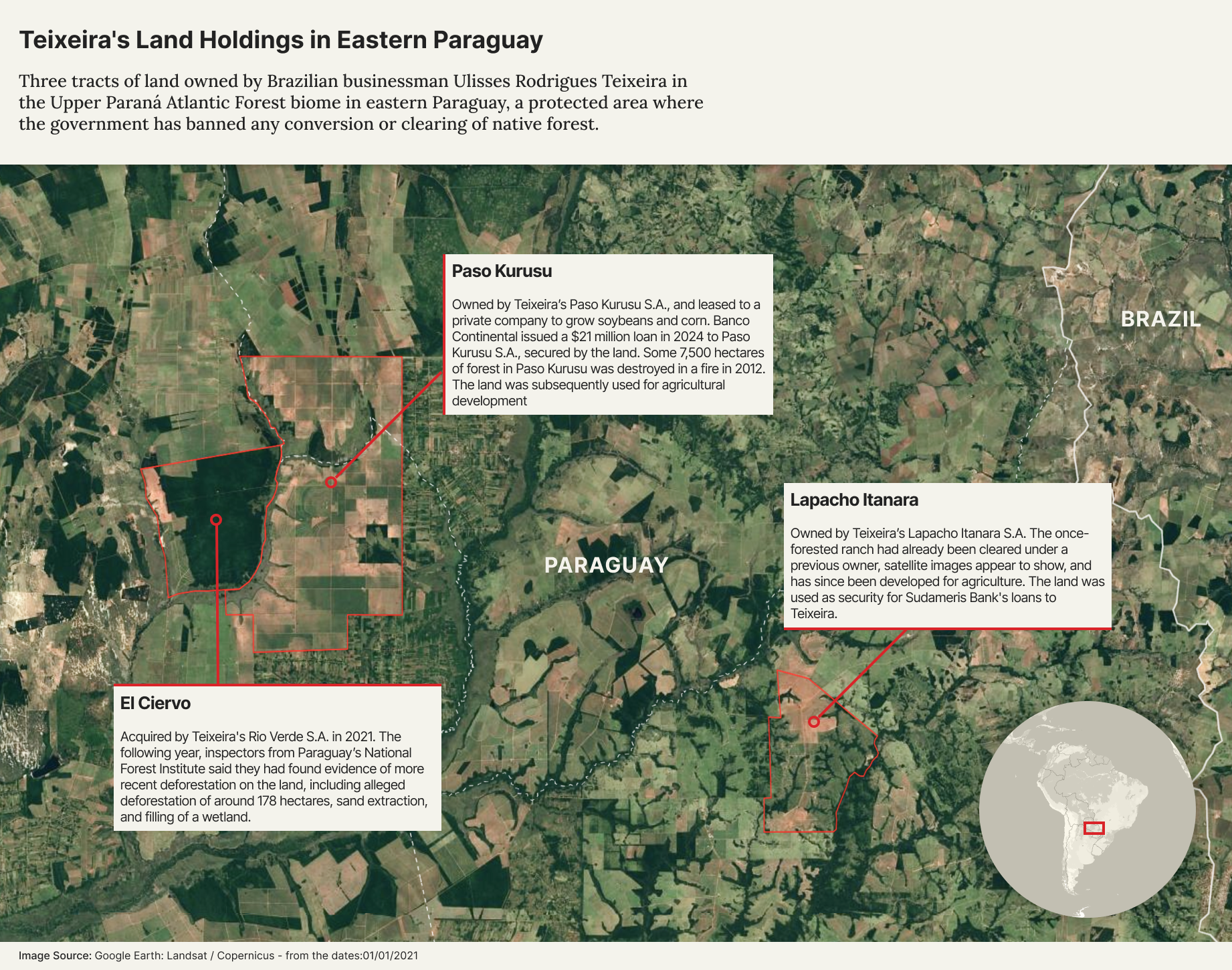

The banks, Sudameris and Banco Continental, issued the loans to two companies belonging to Brazilian national Ulisses Rodrigues Teixeira, who in a 2022 plea agreement admitted he was guilty of environmental crimes relating to a 2012 fire that destroyed 7,477 hectares of natural forest on protected land he owned. Teixeira denied intentionally burning the forest, but admitted to not having established a fire prevention and management plan for the land.

The two financial institutions have both publicly pledged to avoid financing projects that could lead to illegal deforestation, and are founding members of a sustainable finance roundtable convened to establish environmental protection standards for Paraguay’s financial sector. But their loans to Teixeira’s companies were secured by pledges of protected land in a highly biodiverse part of eastern Paraguay.

Sudameris’s earliest loan to a company owned by Teixeira, Lapacho Itanara S.A., was in 2008, but the bank lent another $15 million to the firm after Teixeira’s 2022 plea deal. Banco Continental loaned $21 million to Teixeira’s Paso Kurusu S.A. in 2024.

Teixeira did not respond to multiple requests for comment.

There is no evidence that Teixeira oversaw subsequent deforestation on the lands, which appear to have been cleared before the Sudameris and Banco Continental loans were issued. But the revelations prompted calls for Paraguayan financial institutions to pay closer attention to environmental protection.

“Banks should not grant financing to any person or company that has admitted some kind of environmental crime or that is linked to illegal deforestation … and if they did that, that credit must be cut off,” Alfredo Molinas, Paraguay’s environment and sustainable development minister from 2004 to 2007, told OCCRP.

Rodrigo Zárate, coordinator at Guyra Paraguay, an environmental NGO, called for better oversight of lending.

“Financial institutions should have strict environmental safeguards to prevent their funds from ending up financing people with a history of illegal deforestation,” he said. “Banks should … [be] rigorous in their monitoring and in their evaluations.”

Sudameris declined to comment on specific customers, but told OCCRP it engages “with every one of our clients on their social and environmental obligations, both towards local regulations and our own internal standards,” and that it had developed internal environmental credit checks and monitoring tools in cooperation with international development banks. The bank said its account managers were required to screen all credit proposals for court rulings, and added that “non-compliant clients can eventually be exited.”

Banco Continental declined to comment on “matters that may be subject to legal or regulatory proceedings.”

Financial Backing From Dutch Development Bank

The area in eastern Paraguay where the land is located, the Upper Paraná Atlantic Forest biome, is home to dozens of vulnerable or endangered species, including jaguars, woolly spider monkeys, and red-tailed parrots. Much of their habitat has been cleared in recent decades to make way for industrial cattle ranching and soybean production, which also threatens the livelihoods of more than 400 indigenous communities who depend on the forest.

To curb the practice, Paraguay in 2004 passed a so-called “zero-deforestation” law, which prohibits conversion or clearing of native forest in the country’s east.

Despite the law, some 7,500 hectares of forest on protected land owned by one of Teixeira’s companies was destroyed in a fire in 2012. The land was subsequently used for agricultural development, according to a summary of a government investigation into the fire. In 2022, Teixeira admitted to failing to implement a proper fire-management plan for the land and agreed to donate money to local schools and hospitals in compensation.

The same year, inspectors from Paraguay’s National Forest Institute, known as INFONA, said they had found evidence of more recent deforestation on El Ciervo, another property acquired in 2021 by Teixeira’s company Rio Verde S.A. that was also protected under the zero-deforestation law. They reported their findings to prosecutors, including alleged deforestation of around 178 hectares, sand extraction, and filling of a wetland.

INFONA’s president, Cristina Goralewski, told reporters that prosecutors opened an investigation into one of these reports. The case was dismissed after the statute of limitations expired, according to the public prosecutor’s office.

INFONA has been monitoring land owned by Teixeira’s companies for several years, and has issued 808.5 million guaraníes (around $129,000) in fines to his companies for environmental damages, including deforestation, unlawful soil extraction, obstructing natural bodies of water, and the illegal filling of wetlands, with the earliest infraction dating back to 2019.

Gorwalewski said that INFONA had also sent several complaints to the public prosecutor’s office over these issues, but that it was unclear what had come of them.

“By law, we can impose administrative sanctions — that is, fines — and we do, but that’s all,” she said.

Sudameris’s first loan to Teixeira’s Lapacho Itanara S.A. was in 2008. To secure the loan, the company pledged the Lapacho Itanara ranch, located in Paraguay’s protected Eastern region. The once-forested ranch had already been cleared under a previous owner, satellite images appear to show, and has since been developed for agriculture.

After Teixeira admitted in 2022 to charges of failing to mitigate environmental impact relating to the fire on separate land his company owned, Sudameris made an additional loan worth $15 million to his firm, mortgage documents show. In total, the bank loaned Lapacho Itanara S.A. $42.5 million from 2008 to 2024.

Sudameris pledges not to finance projects or companies whose activities include destruction of areas of high conservation value or conversion of native forests for agricultural activities without permission from the responsible authorities. The bank declined to explain the purpose of the loans to Lapacho Itanara S.A., citing confidentiality.

Banco Continental issued a $21 million mortgage loan in 2024 to Teixeira’s Paso Kurusu S.A. The loan was secured by a pledge of land in the same area where the fire occurred more than a decade earlier. Banco Continental also declined to explain the purpose of the loan. The land is currently leased to a private company to grow soybeans and corn.

Noah Moeys and Jasper Been (Het Financieele Dagblad) contributed reporting.