Reported by

An executive who allegedly played a key role in one of Asia’s biggest crime organizations — which was hit with U.S. and U.K. sanctions this week — purchased at least 29 prestige properties in Dubai, while his wife bought five luxury apartments in London, real estate data shows.

Zhu Zhongbiao was targeted in part of a sweeping sanctions package announced by both the U.S. Treasury Department and the U.K’s Foreign, Commonwealth, and Development Office on October 14. Treasury accused Zhu of being a part of an alleged multi-billion scam and money laundering empire called the “Prince Group Transnational Crime Organization.”

The U.K. Office of Financial Sanctions Implementation alleged in its announcement that Zhu “is or has been involved in the operation of scam centres in Cambodia, including through the Jin Bei group of companies.”

Zhu is listed in Cambodian company registries as the chairman and owner of Jin Bei Group Co Ltd, and all of its multiple corporate subsidiaries. American authorities say Jin Bei Group owns a string of casinos that have allegedly hosted multiple scam compounds.

Treasury called Jin Bei’s compounds “among the most notorious of those owned by Prince Group” that engaged in scamming, extortion, and forced labor. Zhu is separately wanted by Chinese law enforcement for charges related to money laundering, Treasury said.

The Prince Group is allegedly part of a booming criminal industry in Southeast Asia, which uses “sophisticated schemes, including scams in which people are lured into fake romantic relationships, to defraud victims on an industrial scale,” the U.K. foreign office said.

“Those conducting the scams are often trafficked foreign nationals, trapped and forced to carry out online fraud under threat of torture,” it added.

Authorities in the U.S. and U.K. allege that chairman of the Prince Group, Chen Zhi, is the leader of the scam and money laundering network. In addition to the sanctions handed down by Treasury, the U.S. Department of Justice unsealed an indictment on October 14, accusing him of being behind “forced-labor scam compounds across Cambodia in which workers were made to execute the scams at high volumes.”

A “phone farm,” an automated call center used to carry out cryptocurrency investment scams, as shown in a U.S. indictment.

Chen’s whereabouts are unknown. He has held citizenship in China, Cambodia, Vanuatu, St. Lucia and Cyprus, according to the indictment, and lived part time in the U.K.

British authorities said they had frozen 19 London properties held by “the leader of the network, Chen Zhi, and his web of enablers,” including a mansion worth $16 million and an office building worth $133 million.

Authorities in the U.K. and U.S. sanctioned several people who they alleged were Chen’s associates. These include Zhu, who also poured money into real estate, according to leaked Dubai property data obtained by OCCRP. The properties owned by Zhu in Dubai, and his wife in the U.K., have not previously been reported.

Passports and Property

Zhu acquired Cambodian citizenship in 2017, and changed his name to “Zhu Jack.” He subsequently acquired Cypriot citizenship in September 2018 along with his spouse Wang Xiaoyan, Cyprus records show. Last year, however, a Cypriot government spokesperson reportedly announced that it would revoke the passports of Zhu, his wife, and their child, after an investigation by the country’s Interior Ministry.

Cypriot authorities have not responded to an OCCRP request for more information about the investigation or confirmation that their citizenship has been revoked.

Zhu was also a resident of Dubai, United Arab Emirates records show. He is recorded as last leaving the country in May 2025.

According to Dubai property ownership and tenancy contract data reviewed by OCCRP, Zhu has purchased at least 29 properties in the emirate. He bought most of them between 2019 and 2022. OCCRP could not verify whether he has since sold some of these properties.

The real estate assets include two entire floors — comprising 16 units — of the Creek Rise Tower 2, a luxury condo complex in Dubai Creek Harbour. Zhu also purchased at least one unit in another nearby development, The Dubai Creek Residences.

The Dubai Creek Harbour, where Zhu Zhongbiao purchased units in two buildings.

The combined purchase value of Zhu’s Creek Rise properties are worth at least $7.9 million, according to the leaked data.

Zhu also purchased at least 10 units in HDS Tower, a prime office building near the Dubai Marina, as well as office space units in the Tamani Arts Office Building that overlooks the iconic Burj Khalifa.

There is no available data on the purchase value of Zhu’s office property investments. However, most individual HDS Tower units are advertised for sale at between $400,000 and $680,000.

Most of Zhu’s Dubai purchases were conducted between 2019 and 2022, after he became chairman of Jin Bei Group in 2018. Dubai tenancy contract data also show that at least 27 of his properties have been officially leased at various points up until 2024, and have been generating rental income.

Meanwhile, Wang Xiaoyan, Zhu’s spouse, is the sole controlling shareholder of a U.K. company called Fuheng Wang Group Ltd, which collectively purchased at least five luxury London properties between 2021 and 2022. She still owns the properties, which do not appear to be among those frozen by U.K. authorities.

Wang’s properties are collectively worth at least $6 million, including apartments on the 59th floor of the Landmark Pinnacle in Canary Wharf. She has also invested in three units of a residential development adjacent to the former Battersea Power Station, U.K. property records show.

The Landmark Pinnacle in Canary Wharf, London, where Wang Xiaoyan owns properties.

Wang Xiaoyan did not reply to requests for comment sent to a London company services provider, where Fuheng Wang Group rents an office. The company’s secretary confirmed that Wang rented an office but that she had never seen her in person.

Wang has not been sanctioned by either the U.S. Treasury or the U.K. government. She was listed as Zhu’s wife in the couple’s 2018 application for Cypriot citizenship, and there is no indication that they have since divorced.

Zhu has at least four U.K. companies that were incorporated at the same London residential address as Fuheng Wang Group, although their business purpose and asset profile remain unclear.

Zhu did not reply to requests for comment sent to personal and business email addresses associated with his Cambodian companies.

Chen, Prince Group and Jinbei Group did not respond to questions sent to emails associated with their company addresses and lawyers. Cambodian authorities did not reply to requests for comment.

Global Operation

According to U.S. government estimates, Americans lost $10 billion to Southeast Asia-based scam factories in 2024. Those run out of Prince Group sites were “particularly significant," Treasury said.

The U.S. Department of Justice has seized some of the alleged profits from those scams — totalling $15 billion worth of Bitcoin cryptocurrency — which it called its “largest ever forfeiture action.”

In its indictment, the justice department noted that the Prince Group had “assistance from local networks,” including one called the “Brooklyn Network,” operating out of New York. The trial has not yet started.

Members of the Brooklyn Network “facilitated an investment fraud scheme perpetrated by scammers at Prince Group's Jinbei Compound,” according to prosecutors. Victims thought they were making legitimate investments, but deposited funds into accounts of companies that were allegedly controlled by the Brooklyn Network.

That was just one node in “a complicated network of over 100 shell and holding companies all around the world” that the Prince Group used to launder illicit money, Treasury said in its statement this week.

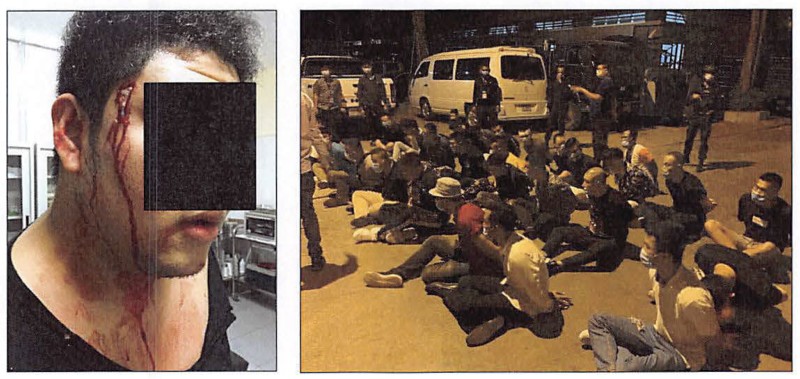

Images found on Chen Zhi's phone, allegedly showing abuses of scam center workers by the Prince Group.

The Prince Group controls shell companies in the British Virgin Islands, the Cayman Islands, Mauritius, Taiwan, Hong Kong and Singapore, according to Treasury. The group also has investments in Laos and the Pacific island nation of Palau.

Among those sanctioned this week was Wang Guodan, also known as Rose Wang, a Chinese woman who authorities say oversaw Prince Group investments in Palau, including a luxury hotel development on a private island. A 2022 OCCRP investigation showed how Wang helped a notorious triad boss build ties with a former president of the country.

Wang did not respond to requests for comment on the U.S. sanctions against her.

While the Prince Group’s network stretches across the world, its nucleus is in Cambodia. Through various companies, the operation allegedly “comingles illicit revenues with the legitimate Cambodian economy,” Treasury said.

Zhu — the owner of Dubai properties — allegedly plays a key role in the Prince Group in Cambodia, according to Treasury. Among other corporate roles, he is director of Cambodian Heng Xin Real Estate Investment Co. Ltd., which is involved in the Prince Group’s “scam business,” Treasury said.

Zhu now faces both sanctions and legal charges, as government authorities follow the Prince Group’s multi-billion dollar worldwide paper trail. But with his high-end properties and multiple passports, he still might have many places he can go.