This year’s blackouts in Venezuela weren’t the first time the country’s citizens were forcibly acquainted with the dark.

Drought and crumbling infrastructure in 2010 drove the electric system to the brink of collapse: Pre-arranged power cuts snarled traffic in major cities, hospitals were unable to provide dialysis to kidney patients, and the government’s working hours were slashed.

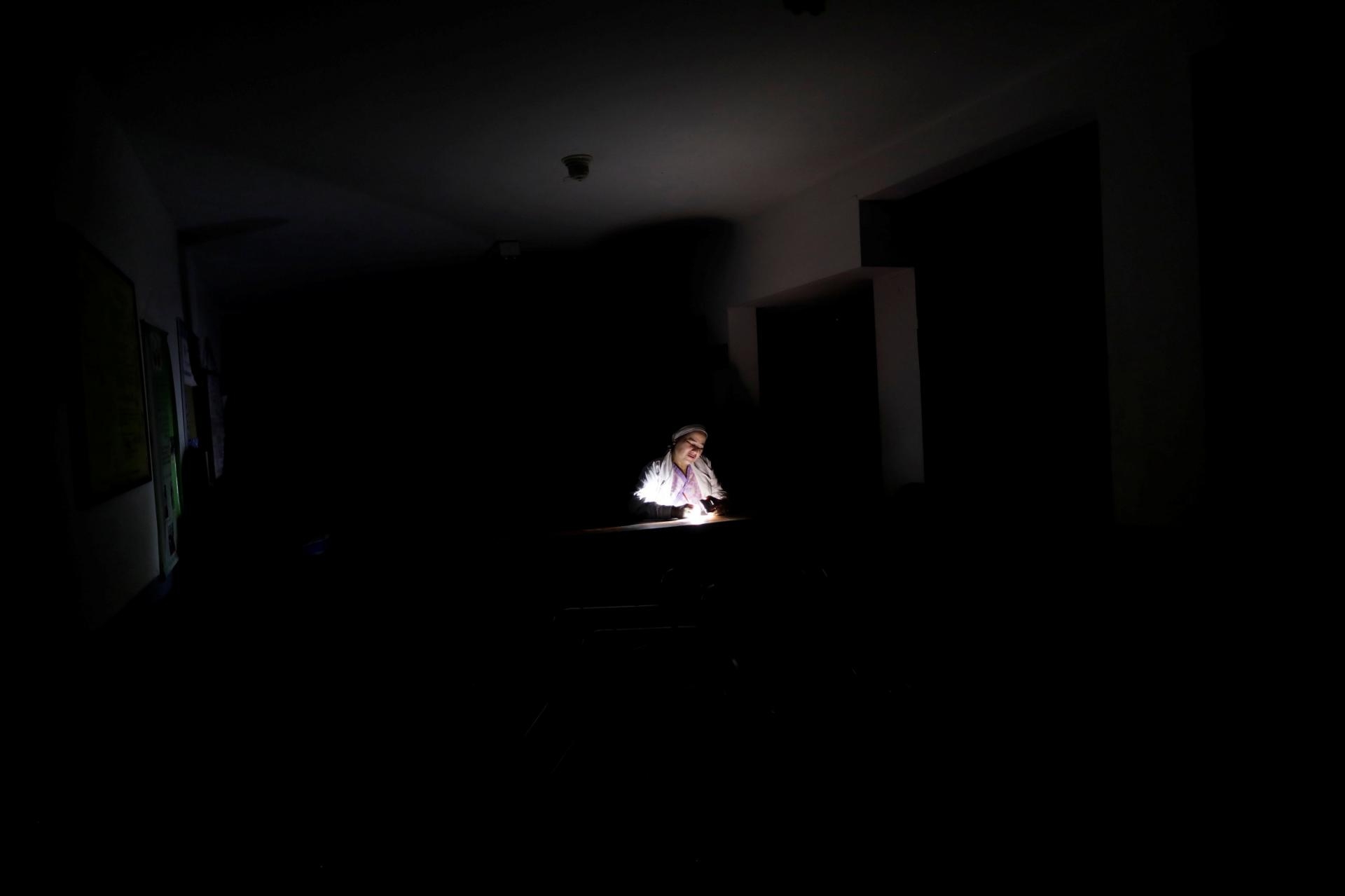

Venezuelans became accustomed to living by candlelight — and they made their anger known through huge pan-banging protests known as cacerolazos.

The socialist leader of the oil-rich country, Hugo Chávez, presided over an unprecedented deterioration in public services, and his popularity was at an all-time low. He blamed the power cuts on everything from Colombian spies, to people who sang in the shower (the country depends largely on hydroelectricity), to the political opposition, whom he called “the squalid ones.”

“The squalid ones are hoping it won’t rain, but it’s going to rain, you’ll see, because God is a Bolivarian!” Chávez proclaimed, using his preferred term for his political movement. “God cannot be squalid. Nature is with us.”

Chávez found more immediate earthly assistance in the “Bolichicos,” the nickname for a group of elite and well-connected young men from upper-class families.

Sensing an opportunity amid the chaos, two Bolichicos, then-29-year-old Alejandro Betancourt and his 26-year-old cousin Pedro Trebbau, decided to start their own electricity company called Derwick Associates.

According to José Aguilar, a member of the Ricardo Zuloaga Group, a think tank that has examined power-supply contracts awarded in Venezuela, neither man had experience in the energy sector, nor did OCCRP journalists find any evidence of such. (In an email, the company told OCCRP that both its shareholders and its employees had “enough proven experience to compete for all Derwick’s contracts,” although it did not elaborate further.)

Whatever the case, Derwick enjoyed a meteoric rise. It won US$5 billion in contracts from state energy companies in just 14 months from 2009 to 2011, including 11 projects to build new plants and one to modify an existing facility.

Each contract was awarded without a competitive bidding process, because Chávez had suspended Venezuela’s normal procedures due to the energy emergency. The contracts also included advance-payment provisions that meant Derwick didn’t have to put up money to buy equipment, and usually didn’t pay up front for installation or construction, according to Simon Saturno, a Venezuelan electrical engineer who conducted an analysis of Derwick’s work for the anti-corruption organization Transparencia Venezuela.

“Each purchase was the subject of a contract and each contract, depending on the options that Derwick offered, established a payment method that could include an advance, a sufficient advance so that Derwick could buy the equipment,” Saturno said.

(In a statement to Venezuelan prosecutors in 2013, Betancourt denied this and said Derwick had put up all the capital for all its projects, even advancing funds for some of them.)

According to a 2013 lawsuit filed by former U.S. Ambassador to Venezuela Otto Reich against Betancourt, Trebbau, and another alleged associate, the company paid massive bribes to land the contracts. (The lawsuit was later dismissed.)

A few years later, although the government’s huge investment in power infrastructure had initially stabilized the crisis, Venezuela was still experiencing frequent blackouts.

One thing had changed, though: The Derwick Bolichicos were now very wealthy. Starting in 2010, three companies closely associated with Betancourt and Trebbau were founded in Spain and began making costly real estate purchases.

In 2011, a company called Derwick Associates International was registered, with both men listed in administrative roles. In 2012, the company registered the purchase of a 1,396-hectare hacienda in Toledo; the estate includes an old castle and was traditionally used as a hunting ground for the aristocracy. Although the sale price was not available in public records, the company, which has since changed its name, declared over 30 million euros in assets in 2017.

Trebbau is also the main administrator for another company founded in 2010, Eiffel Real State, which owns a lavish apartment in one of the wealthiest neighborhoods in Madrid, just behind the Prado Museum and near El Retiro park. Eiffel now has assets of over 3 million euros. And Betancourt and his mother, Lilia-Cristina Lopez, are administrators of a similarly named company, Guanabana Real State, which owns another luxurious apartment in central Madrid and has declared assets of over 1 million euros.

According to the complaint filed by Reich, the former U.S. ambassador, Betancourt also owns a $11.5 million penthouse apartment in New York City, which he bought in 2012 through a Delaware-based company, according to New York property records. And in 2016, the businessman led a group that invested 50 million euros in a fashionable sunglass company, Hawkers, that has partnered with soccer star Lionel Messi to design a line of eyewear.

“A Gesture of Gratitude”

A trove of financial documents leaked from the Swiss bank Compagnie Bancaire Helvetique (CBH) last year provided even more information about the scope of the Derwick owners’ wealth, as well as revealing that they had been awarded the right to exploit oil fields by Venezuela’s state oil company.

Between 2011 and 2013, even as power cuts continued and Venezuela began its descent into the worst economic crisis in its history, huge fortunes accumulated in CBH accounts that belonged to officials and businessmen linked to the Chávez government, including the Derwick principals. Between January and September 2013, Francisco Convit, another “Bolichico” who had partnered with Betancourt and Trebbau on an oil venture, received transfers of more than $77 million and Betancourt of more than $115 million.

Betancourt received almost $5 million and Convit about $2 million from the Bahamas, a jurisdiction known for hosting secretive offshore companies. The leaked records show that both men also held accounts at the Canadian Royal Bank. Convit also had an account at HSBC in Monaco, while Betancourt held an account at JPMorgan Chase in the United States.

With the aid of the new bank files, journalists from the Venezuelan publications El Pitazo, Runrun.es, and Armando.info, alongside the Spanish online newspaper El Confidencial, traced the flow of as much as $100 million a year among the Bolichicos, their relatives, and offshore companies under their control. For this story, journalists from OCCRP built on these earlier Spanish-language publications in collaboration with El Pitazo.

The leaked data also contained an internal memo written by Charles-Henry de Beaumont, a former financial manager charged with managing Betancourt and Convit’s accounts, and Leandre Sappino, now a CBH deputy director.

Beaumont and Sappino’s memo was written as part of a due diligence check and sent to several CBH executives. It reveals, for the first time, that the two Bolichicos were awarded the right to exploit oil by the Venezuelan government in gratitude for their help during the 2009–2010 energy emergency.

According to the memo, the Derwick executives received favors from the Venezuelan government and state oil company Petroleos de Venezuela (PDVSA) after they imported and installed power generators in hard-hit areas during the blackouts.

“They built their reputation during Chávez’s second term, during the electricity crisis in Caracas,” they wrote. “While Chávez accused the Americans and other imperialists of having sabotaged the electrical system, Alejandro and Francisco imported huge generators that allowed the president to restore the situation and save his reputation.”

“Since that day, the government and PDVSA have been very grateful to Derwick and its economic beneficiaries,” the memo continued. “It goes without saying that, since PDVSA just pays its providers as it pleases, Derwick organized numerous drilling parts etc. to let PDVSA maintain its production! In a gesture of gratitude, PDVSA, which sold numerous wells in the Orinoco Basin to oil and gas majors, let Derwick take the lead on a well that produces more than 100,000 barrels a day.”

At 2012 prices, that amount of oil would have been worth over $3 billion a year.

The authorization to exploit the oil fields was granted during the administration of Rafael Ramirez, then the president of PDVSA and later Venezuela’s ambassador to the United Nations. Ramirez was also the official during whose term the fledgling company were given contracts to build four power plants in 2010 and 2011.

In an interview, Ramirez said the power plant contracts were awarded as part of an effort to free PDVSA from corruption and anti-Chávez “sabotage” by opening up the company to more diverse suppliers.

He said that Derwick’s presence in the Petrozamora venture was not known to PDVSA.

“I do not know how Derwick got there,” he said.

Powerless

But even as Derwick’s Bolichicos were reaping financial rewards from their energy interventions, the power plants they built were severely underperforming.

A 2018 analysis by Transparencia Venezuela paints a clear picture of how Venezuelan taxpayers were short-changed by their government’s deals with Derwick.

The anti-corruption organization found that the real cost of the 11 projects built by Derwick for $5 billion should have been $2.1 billion. This means that the Venezuelan government was overcharged by 138 percent.

In an emailed response, Derwick’s public relations office denied the accusation. “There are no overprices in the contracts between Derwick and its clients. The figure of 2.1 billion dollars surpasses the total billing of all Derwick’s projects with its clients in Venezuela.”

“Despite all the well-known difficulties and risks involved in working in Venezuela, Derwick’s price per installed MW is among the cheapest in Venezuela and aligned with international prices,” the company added.

Transparencia also found that three of the 11 projects were not in service as of 2014, and none are generating the planned amount of power. (Responsibility for one of the projects was transferred to another company.) Of the original contracted capacity of 3,516 megawatts, the Derwick plants are currently producing about 827. (One megawatt provides enough electricity to meet the energy needs of 750 homes).

No feasibility studies for the Derwick power plants were ever conducted, nor were there proper schedules for installation, testing, and start-up, Transparencia said.

According to Jose Aguilar of the Ricardo Zuloaga Group, the low operational capacity of Derwick’s projects for PDVSA, state power company Corpoelec, and Siderurgica del Orinoco (Sidor), Venezuela’s largest steel corporation, has been “really disastrous.”

In one case, in 2010, Derwick was hired to install two electrical plants at facilities run by Sidor in the state of Bolivar. Derwick completed just one of the plants, and even that one couldn’t operate because it did not have a sufficient supply of gas. According to Aguilar, Derwick charged full price for the installation of 440 megawatts, but only 185 megawatts were delivered.

Machinery for the other plant was never even assembled. According to Transparencia, the boxes containing its components were abandoned in the yards around Sidor’s Bolivar headquarters. A report by Corpoelec in September 2013 said that a $100 million investment would be lost if the equipment wasn’t installed as soon as possible. (The turbine for that plant has since been moved to another site).

Moreover, more than 60 percent of the turbines Derwick bought from Energy Part Solutions, owned by ProEnergy, were secondhand, although the owners of the company claimed otherwise. Some of the cheaper used machinery was brought in from the U.S. and Tanzania, according to documents leaked by Daniel Rosenau, then an employee of ProEnergy, Derwick’s U.S. supplier, which was subcontracted to do the bulk of the work on its first plants.

A parliamentary commission in 2017 examined a subset of Derwick’s projects and calculated that the company billed the state $1.5 billion for work that should have cost about $551 million, a 173 percent overcharge.

Derwick officials have told the Venezuelan National Assembly they couldn’t provide more information about the contracts because of confidentiality clauses, but that their average cost was within international standards.

Trebbau explained to Venezuelan prosecutors in 2013 that Derwick paid more than market prices for electrical equipment used in the blackouts because the company incurred high costs by moving quickly to resolve the crisis.

However, Saturno, the electrical engineer hired by Transparencia to analyze the Derwick plants, said the prices were too high, and the work too shoddy.

“Derwick & Associates was a company that managed, through influence peddling, to do business ... in which equipment was sold to PDVSA and Corpoelec with overcharges, compared to the prices of similar equipment in the international market, knowing that in all cases the equipment would not be able to provide the service for which they were manufactured, because they did not meet the design requirements of the electrical system in which they would be included,” he told OCCRP.

A Russian Partner

The Swiss memo didn’t only reveal that the Bolichicos were rewarded for “saving Chávez” with a right to exploit oil, but also that they entered into this business as a silent partner in a venture with Russian state-owned company Gazprombank.

In 2011, barely a year after the Bolichicos entered the energy business, a new company named Derwick Oil and Gas was set up in Barbados. Betancourt, Trebbau, and Francisco Convit were appointed as directors.

Soon, the Swiss memo reveals, Derwick Oil and Gas had quietly partnered with Gazprombank, one of Russia’s largest banks, which provides services to key sectors of the Russian economy, including the oil and gas industry. They formed a joint venture called Gazprombank Latin America Ventures (Gazprombank LAV).

Such a partnership is legal, but Derwick had no prior experience in the oil industry, and its involvement in Gazprombank LAV wasn’t easily found in public records.

Gazprombank LAV in turn partnered with the Venezuela Oil Corp (Corporación Venezolana del Petróleo), a PDVSA affiliate, to create a company called Petrozamora, which was intended to exploit petroleum resources in Zulia, an oil-rich state in northwestern Venezuela.

This was the company that was awarded the right to exploit a field that could produce 100,000 barrels a day, as described by Beaumont and Sappino in the memo. In 2012, Venezuela’s National Assembly approved the creation of Petrozamora and gave it a 25-year lease to exploit these oil fields. This was the same year that allegations of corruption against Derwick executives first became public and were taken up by Venezuelan anti-corruption authorities.

Although Petrozamora’s contract said it should sell its oil exclusively to PDVSA, the new joint venture was allowed by PDVSA to ignore this provision and sell directly to customers, a major competitive advantage, the memo claimed.

“Gazprombank has an even bigger advantage in working with Derwick because, unlike other companies that have contracted with PDVSA, Derwick sends its oil directly to the market and pays its shareholders in a very reasonable time,” Beaumont wrote.

In April 2015, Venezuela’s National Assembly awarded Petrozamora four new oil fields, even though the government had already begun to investigate allegations of corruption on Derwick’s projects.

However, in 2017 a new attorney general, Tarek William Saab, was appointed by the regime-dominated Constitutional Assembly. He ordered an investigation into Petrozamora’s procurement operations, prompted by complaints from Russian associates of Gazprombank LAV.

His office ultimately arrested nine people for charging illegal commissions and sabotage, resulting in the loss of 15 million barrels of oil between 2015 and 2017. This was part of a huge overall decline in Venezuela’s oil production in the two decades since Chávez took power, despite having some of the biggest oil reserves in the world. Three months after the arrests, in December 2017, Ramirez resigned from his UN post at the request of Venezuela’s current president, Nicolás Maduro, a protege of Chávez.

In March, Reuters reported that Gazprombank had sold its stake in Petrozamora following the imposition of U.S. sanctions on PDVSA in January. After years of favorable treatment, the status of the venture is unclear today.

Trebbau’s current whereabouts are also unclear. Convit was indicted in July 2018 by U.S. authorities for involvement in a money-laundering ring that sought to bring some $1.2 billion embezzled from PDVSA into the U.S. through real-estate deals and fake investment schemes. Neither man could be reached for comment.

In an email interview with El Confidencial, Betancourt’s lawyers and advisers denied that Derwick was involved in a joint venture with Gazprom. They said he had never been charged or convicted with a crime, and that all Derwick’s power plants were “delivered at the negotiated and justified times.”

“All plants were delivered operative and with 100% customer satisfaction,” he said. “The company is not in charge of the operation/maintenance of them.”

From Dark to Darker

The corruption in Venezuela’s power and oil sector doesn’t just have theoretical implications.

Despite its vast oil reserves and the fact that it spent an estimated $37.7 billion between 2000 and 2014 upgrading its power infrastructure — more than 12% of which went to Derwick — the country has been plagued by so many blackouts in recent years that a group of angry citizens founded an NGO to keep track of them, the Committee of Those Affected by Blackouts.

In January 2019 alone, the committee reported 1,025 power cuts nationwide.

But Venezuela’s most recent string of blackouts might be the worst yet. The entire nation came to a standstill on March 7 after a fire broke out in the main power lines of the Guri Dam hydropower plant, where most of the country’s electricity is generated.

For days, just a small fraction of Venezuelans were able to connect to the internet, and most flights in and out of the country were delayed or grounded. The Caracas metro stopped operations for almost a week, and the government was forced to declare a four-day holiday.

In hospitals, already struggling with shortages of medicine and equipment, at least 24 people died due to the blackout, according to the non-governmental organization Doctors for Health.

Water shortages have led hundreds of desperate residents of Caracas to collect water from drainpipes or the Guaire River, which carries sewage through the city.

In a country where temperatures often reach 30 degrees Celsius, Venezuelans are passing around advice sheets about how to preserve food in salt and lemon to avoid spoiling, use sour milk to make yogurt, and insulate refrigerators with heavy cloth sheets.

Raimundo Rincón, a Caracas resident, said he was spending much of his time struggling to care for his sister, a diabetic who must inject herself with refrigerated insulin, and his mother, a colon cancer survivor with a colostomy.

“We didn’t have water until today. We could only pick up a bit for her, to [help her] clean her bag and wash herself minimally,” he said.

“Although in November 2018 we published a report about the energy sector, in which it was clear that the whole electric system was going to collapse … nothing really prepared us to spend 80 hours without the light,” Mercedes de Freitas, the head of Transparencia Venezuela, told OCCRP.

Like Chávez before him, Venezuela’s current president, Nicolás Maduro, who is mired in political crisis, has blamed American sabotage for causing the mega-blackout.

But Winston Cabas, the president of the Venezuela Electrical Engineers Association, says there is a more prosaic reason for the desperate situation: poor maintenance and shoddy infrastructure.

At a press conference in Caracas on March 11, he said the thermoelectric plants that were supposed to provide backup for the Guri Dam were not working.

The plants he was referring to included several constructed by Derwick.