Reported by

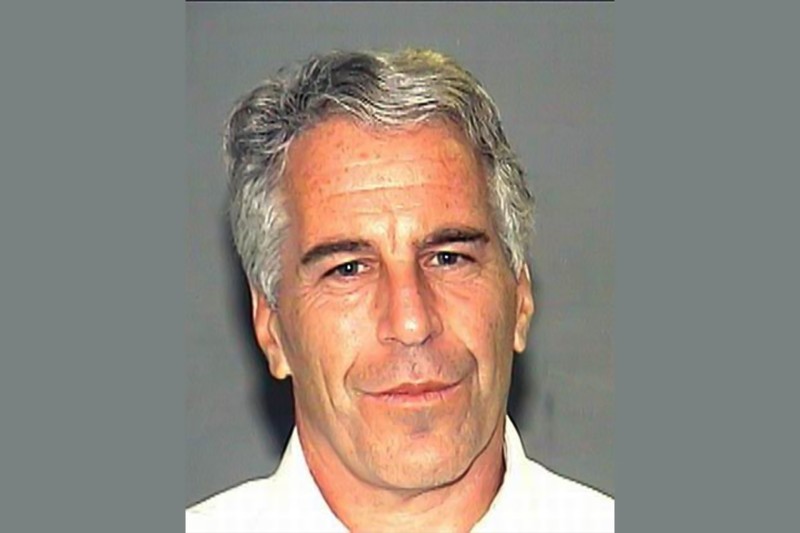

A U.S. senator unveiled proposed legislation today intended to force the Treasury Department to release financial documents containing names of women and girls potentially trafficked by Jeffrey Epstein, the late financier and convicted sex offender.

Ron Wyden, a Democrat from Oregon, is demanding the administration of President Donald Trump release records involving more than $1.5 billion in wire transfers.

"They also reveal potential violations of federal anti-money laundering laws by J.P. Morgan and other banks — compliance failures that helped Epstein continue abusing and trafficking women and girls many years after law enforcement was first alerted to his activities," according to a statement from Wyden’s office.

The move comes after the U.S. Committee on Oversight and Government Reform this week made public files that included a sexually suggestive note bearing a signature that looks like Trump’s. The White House has called the note a forgery, and Trump has denied the signature is his.

Wyden is now the top Democrat on the Senate Finance Committee, which he headed during the previous presidency of Joe Biden. Under Biden’s administration, the committee’s investigative staff reviewed a significant portion of the files in person at the Treasury Department.

“The files detail Epstein transactions totaling at least $1.5 billion dollars, and they include the names of women and girls he may have trafficked, as well as the identities of individuals whose involvement with Epstein may put them at risk of blackmail or other foreign corruption,” Wyden’s office said.

Wyden said he introduced his draft law after repeated attempts to get the Treasury Department to hand over those records. The Treasury Department did not respond to a request for comment before publication.

The proposed legislation follows a New York Times investigation published this week, which showed how J.P. Morgan profited from its relationship with Epstein, even setting up accounts for young women later revealed to be sex trafficking victims.

J.P. Morgan, through a spokesman, told the New York Times that its relationship with Epstein “was a mistake and in hindsight we regret it, but we did not help him commit his heinous crimes.” A J.P. Morgan spokesperson told OCCRP the bank had no comment on Wyden’s draft legislation.

Deutsche Bank was also caught up in the imbroglio around Epstein. In 2020, the New York State Department of Financial Services imposed a $150-million fine against the bank for failing to “detect or prevent millions of dollars of suspicious transactions” related to Epstein, despite being aware of his “terrible criminal history.”

Deutsche Bank did not respond to a request for comment before publication.

The Wyden legislation would require Treasury Secretary Scott Bessent to provide a list of all banks that filed Suspicious Activity Reports on Epstein, and a list of the entities and individuals identified in the reports. It would also require Bessent to provide information on what the Treasury Department and its Financial Crimes Enforcement Network did with the reports it received from banks.

The documents in question at the Treasury Department provide a timeline of Epstein's payments. They could reveal what steps he took after the November 2018 Perversion of Justice series by the Miami Herald, which led to Epstein's arrest a year later and his subsequent death in jail while awaiting trial.

Wyden said he was seeking information from the Treasury Department on 72 entities and individuals that had done transactions with Epstein. The list included a now-defunct trust in Jersey called La Hougue and British solicitor Malcolm Grumbridge. They were the focus of a 2022 investigation by OCCRP and the Miami Herald about the family finances of Epstein’s onetime girlfriend and fellow convict, Ghislaine Maxwell.

Grumbridge acknowledged at the time that he was an “external adviser” to the Maxwell family, but said he had no relationship to La Hougue beyond following the wishes of his clients in regard to the trust, which reporters found had engaged in suspicious trading activities.

Wyden said the files held by the Treasury Department could provide key evidence for a deeper investigation into Epstein.

"From the beginning, my view has been that following the money is the key to identifying Epstein’s clients as well as the henchmen and banks that enabled his sex trafficking network," he said in his statement.