Reported by

Kazakh authorities have accused businessman Sergey Koynov and his associates of operating a network of commission shops that illegally issued high-interest loans secured by personal property and then laundered the proceeds.

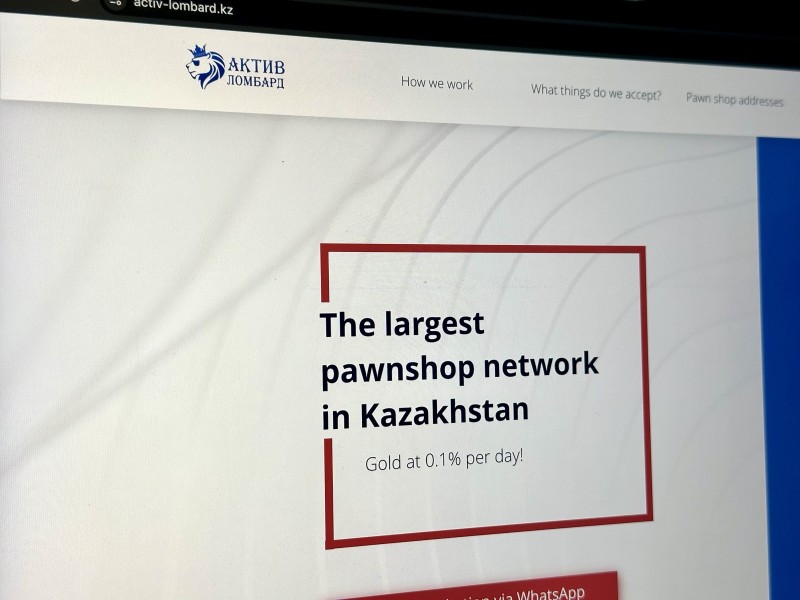

Investigators say the alleged scheme relied on a licensed pawnshop, Active Lombard, and several affiliated firms — including One Billion Sales, The Best Seller and Shark in Sales — that operated under the single “Active Market” brand. While the outlets were presented as ordinary commission shops, authorities say they effectively functioned as unlicensed lenders.

Earlier, Agency for Financial Monitoring Deputy Chair Zhenis Elemesov said the commission agreements used with customers were “formal” and “fictitious,” with fees amounting to roughly 1.73% to 2.07% per day — well above Kazakhstan’s legal cap for this type of lending.

Investigators estimate that more than 1.9 million contracts were signed and that suspected criminal income exceeded about $38 million.

To disguise the origin of the funds, the case file describes repeated transfers between accounts and the use of sham contracts with affiliated entities, followed by dividend payouts totaling nearly $11 million.

A separate company, Zeus Co — nominally an IT business — is alleged to have received about $5 million under inflated software-services contracts. Most of that money was then paid out to Koynov as dividends, according to investigators.

With court authorization, authorities froze assets valued at about $18 million, including four apartments and two houses in Astana, four apartments in the United Arab Emirates, six luxury vehicles — among them a Rolls-Royce Cullinan and a Bentley Bentayga — jewelry, and more than $5 million held in bank deposits.

Koynov is being held in pretrial detention, while four alleged accomplices were placed under travel restrictions. The agency said further details could not be disclosed under Kazakhstan’s criminal procedure rules.