Reported by

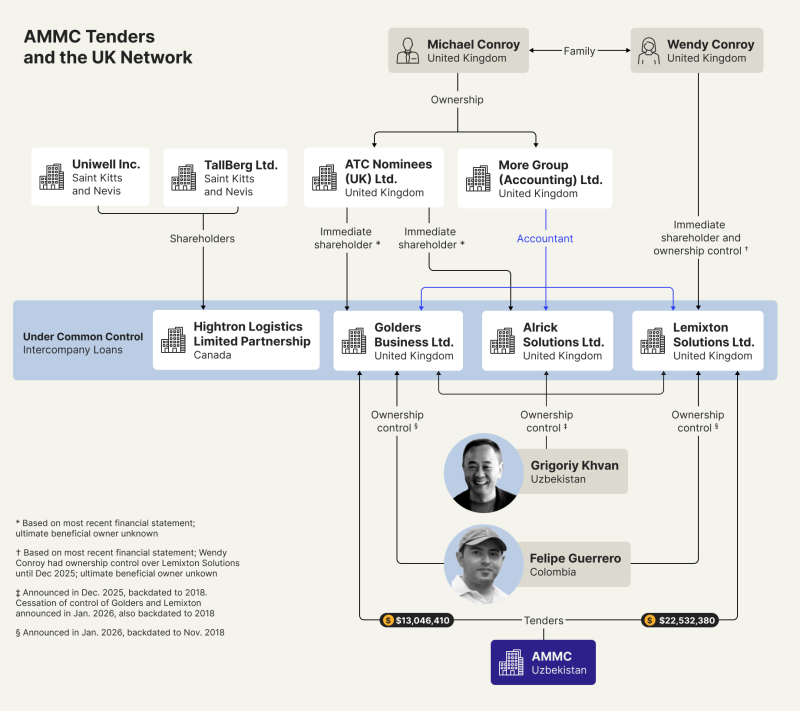

Over the past three years, two U.K. companies with no prior record in the mining industry have won tens of millions of dollars in Uzbek state procurement contracts with a mining behemoth known as a “crown jewel” of Uzbekistan’s economy.

One was owned, on paper, by a septuagenarian British bookkeeper with no evident ties to Central Asia. The other, by a U.K. corporate services provider that for years managed corporate structures that shielded their true ownership from public view.

But an investigation by OCCRP has found that the two U.K. firms are part of a larger circle of companies stretching from Singapore to the South Caucasus that were awarded more than $200 million in Uzbek state contracts since 2022. The client is Almalyk Mining-Metallurgical Complex (AMMC), a state enterprise that Uzbek President Shavkat Mirziyoyev has slated for a possible initial public offering on a foreign stock exchange.

On the surface, these companies located thousands of kilometers apart appear to have little in common. But OCCRP found they have connections to Grigoriy Khvan, a prominent figure in the Uzbek ping-pong world, or a second man, a Colombian national with no identifiable background in the mining sector.

These links raise questions about whether the individuals named in the companies’ official filings are their true owners, or whether they could be serving as proxies for someone else.

They also underscore persistent lapses in corporate transparency in the U.K., despite recent efforts by the government to tighten regulations and make it harder to create bogus companies.

Following inquiries from reporters in late 2025, the U.K. firms retroactively installed Khvan and the Colombian man, Felipe Guerrero, as “persons of significant control,” according to filings from the U.K. companies registry. In a chaotic sequence of filings, Khvan was added as their owner, backdated to 2018, only to be replaced weeks later by Guerrero, whose control was backdated to that same year.

Furthermore, the two U.K. firms declared themselves as “dormant” during reporting periods in which they were awarded tens of millions of dollars in AMMC tenders and, according to commercially available import-export records, sent numerous shipments of equipment to AMMC.

Under U.K. law, companies are not considered dormant if they have conducted any trade during the reporting year, and it is illegal for firms to submit “misleading, false or deceptive” information “without reasonable excuse.”

AMMC procurement contracts worth more than $7 million with the two U.K. firms also feature the electronic signatures of accounting associates who deny signing the documents or any other involvement in the agreements. One of these individuals says he has since reported the matter to British authorities.

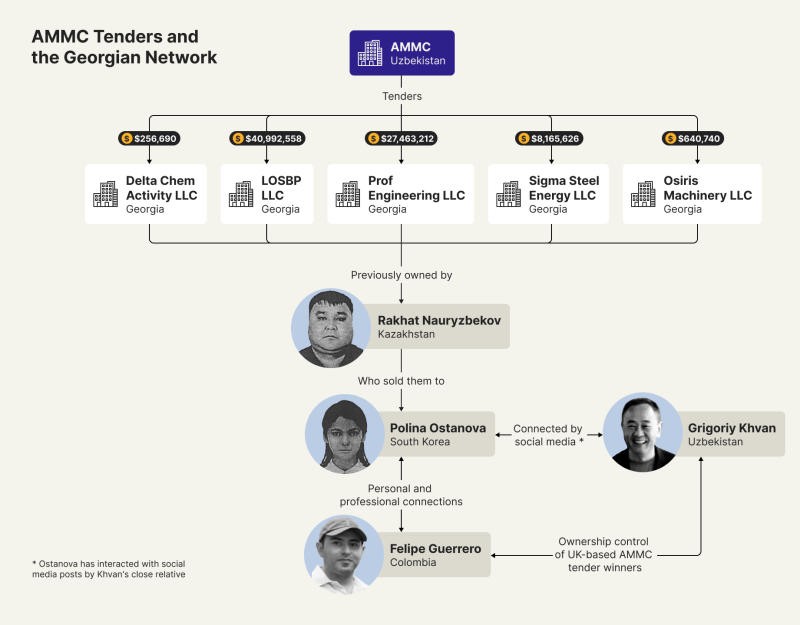

In Georgia, meanwhile, a medical tourism coordinator with no experience in mining purchased firms for just $350 at a time when they had already been awarded a total of $65.9 million in AMMC tenders.

Procurement records show that in dozens of instances the companies competed against one another for AMMC tenders, even when they were under common ownership or control. Most of these companies have no websites, and in multiple cases their listed owners had no other identifiable links to Uzbekistan.

AMMC, which produces copper, silver, gold, other metals for domestic and global markets, and is developing a major copper deposit, contributes around nine percent of total tax revenues in Central Asia’s most populous nation. The tenders reviewed by reporters — which were for the supply of goods such as equipment and raw materials — amount to around seven percent of the company’s total expenditures since 2022.

AMMC’s mining facility in Almalyk, Uzbekistan.

AMMC did not respond to detailed questions about these tenders and whether the winners had delivered on their contracts.

Cronyism and corporate opacity remain endemic in Uzbekistan. Previous OCCRP investigations have revealed how well-connected insiders — including Mirziyoyev’s relatives and their associates — enjoy preferential treatment on lucrative government contracts, sometimes via companies owned through complex offshore networks.

Mirziyoyev announced at a March 2025 meeting of Uzbekistan’s National Anti-Corruption Council in Tashkent that his government would introduce measures to tighten up the tender process and introduce “high anti-corruption standards.”

“Corruption is such an evil that it undermines people’s trust in the state, the constitution, and laws, and becomes a serious threat to sustainable development and security,” he said.

Uzbekistan’s president, Shavkat Mirziyoyev speaking at Uzbekistan’s National Anti-Corruption Council held on March 3, 2025.

About This Investigation

AMMC is among a raft of companies listed in Mirziyoyev’s April decree on privatizing leading state-owned enterprises. A key pillar of this privatization drive has been his pledge to boost transparency, including in public procurement.

Ben Cowdock, senior investigations lead with Transparency International in the U.K., told OCCRP that awarding major state contracts to companies with little relevant background risks their potential failure to deliver on the agreement.

“There's also a danger around contracted companies being owned in the shadows by politically connected individuals, who again might not be well equipped to deliver and might just be using this as a scheme to take money out of a state-owned company,” he added.

Transparency is also important ahead of a possible initial public offering by AMMC on a foreign exchange within the next two years.

In a high-corruption jurisdiction with lots of shell companies active in the economy, privatization “is a big risk,” Cowdock said, adding that “transparency needs to be baked into the privatization process to see who is truly benefiting.”

AMMC, which was honored at a state anti-corruption forum in October for its corporate transparency efforts, did not respond to a request for comment on OCCRP’s findings.

On its website AMMC states that it “is committed to the principles of transparency and accountability in the management of natural resources.”

AMMC’s website.

Mirziyoyev’s administration did not respond to a request for comment.

The British Shell Companies

Over the past three years, a U.K. company called Lemixton Solutions Ltd has won at least 56 AMMC tenders worth a total of $22.53 million. But one wouldn’t know it looking at the company’s official filings.

Incorporated in 2018 at a mass-registration office in London, Lemixton has just one employee, no website, and no identifiable office in Uzbekistan. Since 2021, the company has consistently filed dormant accounts, a legal status reserved for firms with no significant financial transactions.

But since 2022, Lemixton has been one of the most frequent winners of AMMC tenders, securing contracts to supply the Uzbek mining giant with steel pipes, aluminum sheets, and other goods.

And since that same year, Lemixton has delivered goods to AMMC — dozens of shipments in total — in each accounting year for which it declared itself dormant, import-export data shows.

During this entire period, Lemixton’s registered owner was Wendy Mary Ann Conroy, a 71-year-old British accountant with no other known connections to Uzbekistan who had been designated as the firm's person with significant control.

But after OCCRP and Finance Uncovered contacted Lemixton on December 2, 2025, the company made a flurry of retroactive corrections to its corporate structure.

BOX: U.K. Law and ‘Significant Control’

That same day, Conroy was recorded as having ceased to be Lemixton’s person with significant control. Three days later, a new filing asserted that Khvan, the 61-year-old businessman who has served as vice president of the Uzbek Table Tennis Federation, had actually held that role since November 20, 2018.

Khvan’s tenure on the public record, however, was short-lived. In early January, Lemixton filed a notification stating that Khvan’s control had ended on the same day it purportedly began in 2018. In his place, the company identified Colombian national Felipe Guerrero as its new person with significant control. Like Khvan before him, Guerrero was designated as having held this position since that same day in November 2018.

A nearly identical pattern emerged at another U.K. firm, Golders Business Ltd. Like Lemixton, Golders has declared itself dormant since 2021. During that period, however, Golders has won at least $13 million in AMMC procurement tenders and sent more than 100 shipments of goods to AMMC.

In 2018, the firm had officially declared to the registry that it had “no registrable person” — a legal claim meaning that it had no person with significant control. This status was maintained while ATC Nominees (UK) Limited, a firm controlled by Michael Conroy, Wendy Conroy’s son, served as the company’s secretary.

In early December, however, this claim was withdrawn and it was stated that Khvan had been the controlling party since August 1, 2018. But as with Lemixton, this history was revised again in early January when the firm notified the registry that Khvan’s control had ended on that same August date. He was replaced by Guerrero, who was backdated as the firm's controlling party since November 30, 2018.

Who Is Grigoriy Khvan?

Corporate filings and financial records show that both Lemixton and Golders were managed by Michael Conroy’s British firm MoreGroup, which served as the listed accountant for the two firms and whose employees have served as their officers.

In response to Finance Uncovered, MoreGroup’s client relationship director Jaime Barclay said that Wendy Conroy “never should have been put down” as having “significant control” in Lemixton and that an “internal investigation” was being conducted.

Barclay said in the call with Finance Uncovered — conducted a day before Khvan was added to the filings for Lemixton, Golders, and a third related U.K. company, Alrick Solutions Limited — that “one person” was behind all of these companies.

MoreGroup did not substantively respond to detailed questions about the ownership of Lemixton and Golders, including whether Khvan or Guerrero are the ultimate beneficial owners or a proxy for someone else. The company said it did not have “any involvement with the information stated or the documents used.”

“Any suggestion of our connection is incorrect,” it added.

Common Control, From London to the Caribbean

U.K. company filings show that Lemixton and Golders are “under common control” with two other companies: U.K.-based Alrick Solutions and a Canadian company called Hightron Logistics. These companies have close financial ties, with intercompany loans moving between them.

Cowdock of Transparency International told OCCRP that U.K. authorities continue to struggle to ensure accurate data is provided to Companies House, Britain’s government agency responsible for managing the country’s business register.

“The system in place still relies on reactive checks of what is already on the register, which often sees incorrect information left for extended periods of time,” Cowdock said.

Phil Brickell, a British MP and chair of the All-Party Parliamentary Group on Anti-Corruption and Responsible Tax, told Finance Uncovered that the case “calls into question the effectiveness of some of our first lines of defense against suspect financial activity.”

“Specifically, the information provided to, and listed by, Companies House appears to have been of little to no help in identifying who really owns and controls this company,” Brickell said.

"Indeed, it is telling that the Uzbekistan public procurement register seems to have been of substantially more use in establishing whether this U.K. company is actually being run from Kent, or Tashkent,” he added.

The opacity of the two U.K. firms’ ownership and operations is also reflected in contracts the companies signed with AMMC.

Electronic signatures of current and former MoreGroup associates appear on at least 13 such contracts that OCCRP reviewed.

Seven contracts between Lemixton and AMMC totaling $6.2 million feature what appears to be a facsimile of Wendy Conroy’s signature. The most recent of these contracts was dated December 5, 2025 — three days after Wendy Conroy was formally withdrawn as a person with significant control of Lemixton.

MoreGroup’s Barclay told Finance Uncovered that Wendy Conroy “100 percent” did not sign those contracts.

In addition, six contracts between Golders and AMMC — totaling $1.4 million — feature an apparent facsimile of the signature of a former MoreGroup employee named Ruairi Laughlin-McCann.

Laughlin-McCann told OCCRP that he had not been associated with Golders for more than five years and that he has “categorically not signed” the contracts, one of which lists him as the Golders director as recently as November 25, 2025.

“It could not have been accidentally executed by MoreGroup or myself,” Laughlin-McCann said in an email. “The contract due to its nature would have been subject to enhanced due diligence…. It’s inconceivable that at this stage at least, and as a minimum check/balance, it would not be flagged that I am not the director.”

Laughlin-McCann said he had reported the matter to City of London police and Britain’s Serious Fraud Office. The Serious Fraud Office did not respond to OCCRP’s request for comment in time for publication. The City of London Police, citing data privacy, said they could not confirm or deny that Laughlin-McCann had filed a report without his consent.

MoreGroup did not respond to questions about the use of Lemixton and Golders official company stamps on the AMMC contracts with the purportedly forged signatures.

The addition of both Khvan and Guerrero to the U.K. corporate records allowed OCCRP to link the firms to other obscure companies thousands of kilometers to the east that have also won tens of millions of dollars in AMMC tenders.

The Georgian ‘Competitors’

Several firms incorporated in the South Caucasus nation of Georgia have competed for AMMC tenders against the U.K. firms now linked to Khvan and Guerrero. The biggest winners among these were LOSBP LLC and Prof Engineering LLC, both of which have websites showing they operate in the industrial sector.

The owner of the two companies, which together have won $68.45 million in AMMC tenders since 2022, has personal connections to the U.K. firms.

On paper, both LOSBP and Prof Engineering are owned by Polina Ostanova, a 41-year old South Korean citizen with Uzbek roots. Based in Seoul, Ostanova has worked as a medical coordinator and helped establish a company providing medical tourism services. Her professional background shows no prior experience in the mining industry or large-scale industrial exports.

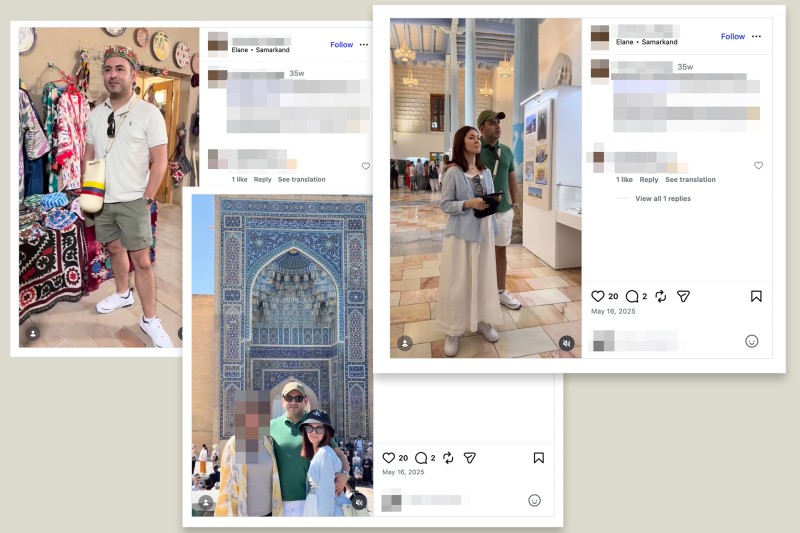

A video posted on Instagram shows Polina Ostanova and Felipe Guerrero taking in the sights together in the historic Uzbek city of Samarkand.

In February, Ostanova bought five Georgian firms, including LOSBP and Prof Engineering, from a Kazakh national named Rakhat Nauryzbekov.

Between 2018 and 2022, Nauryzbekov founded Prof Engineering and two other Georgian companies, and became the ultimate owner of LOSBP and a fifth Georgian firm that he bought for around $35.

According to Georgian corporate records reviewed by OCCRP, Ostanova purchased all five of those companies on a single day in February 2025 for a total price of around $350.

At the time of the purchase, two of the companies had already been awarded a total of $65.9 million in AMMC tenders.

Millions for ‘Inactive’ Firms

On paper, there appears to be no connection between these Georgian firms and the U.K. winners of AMMC tenders. But an OCCRP analysis of Ostanova’s social media accounts shows that she has “liked” posts by Grigoriy Khvan’s longtime romantic partner with whom he has children.

Even more direct is Ostanova’s connection to Guerrero, the Colombian man now listed as having significant control over the two British winners of AMMC tenders.

An Instagram video posted by a friend of Ostanova’s shows her and Guerrero taking in the sights together in the historic Uzbek city of Samarkand. Ostanova has also “liked” numerous Instagram posts of Unicos Cars, the South Korean car dealership that provides Guerrero’s phone number as a contact. They are also both listed as representatives of the same South Korean beauty products firm.

Felipe Guerrero and Polina Ostanova listed as representatives of a South Korean beauty products firm.

Neither Khvan nor Ostanova responded to requests for comment. Reached by telephone, Guerrero said he was not in contact with Ostanova at the moment, and he declined to answer a reporter’s questions about the two U.K. companies. He did not respond to a detailed list of written questions.

OCCRP also reached out to Nauryzbekov for comment on the Uzbek state tenders awarded to Prof Engineering and LOSBP, but he did not respond in time for publication.

The Singapore Connection

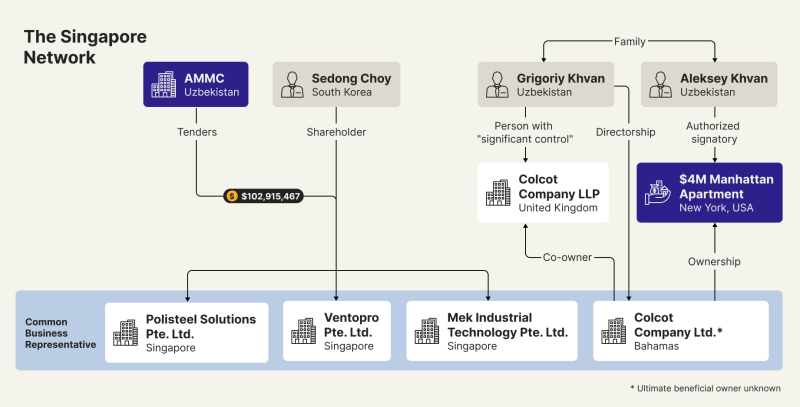

Over the past three years, three companies incorporated in Singapore have won AMMC tenders worth a total of $102.9 million. The listed owner of all three of these companies — Polisteel Solutions Pte Ltd, Ventopro Pte Ltd, and Mek Industrial Technology Pte Ltd — is Sedong Choy, a South Korean national.

Public records reviewed by OCCRP, however, suggest a relationship between the three Singapore companies and the Uzbek ping-pong official Khvan, via a firm in the Caribbean.

A 2025 financial report by a Chinese company, Denair, asserted that the controlling party of Mek Industrial Technology — which has won $7.1 million in AMMC tenders — also controls a Bahamas-based firm called Colcot Company Ltd, where Khvan has served as a director.

Denair later said in a letter that its statement in its financial report was based on the fact that it dealt with both Colcot and Mek Industrial Technology through the same representative. The Chinese firm said it did not have information about the two companies’ beneficial ownership.

While OCCRP was unable to establish Colcot’s beneficial owner, property records show that the Bahamas company purchased a $4.4 million Manhattan apartment in March 2024, and the transaction was signed by Khvan’s son, Aleksey.

Mark Ludwikowski, a Washington, D.C.,-based attorney representing the three Singapore firms who shared the Denair letter with OCCRP, said that according to information available to him, the three Singaporean companies “are not owned or controlled by Colcot Company Ltd or by the same beneficial owner as Colcot Company Ltd.” He told OCCRP that Choy is their sole shareholder and that Khvan “has no ownership interest, no control, and no role — formal or informal — in any of the [c]ompanies.”

Ludwikowksi serves as senior director of the firm Clark Hill Public Strategies, which signed a U.S. lobbying contract with Mek Industrial Technology. But he did not provide details about why paperwork filed with the U.S. government related to his firm’s lobbying for Mek Industrial Technology indicated the country being represented was Uzbekistan, rather than Singapore, or why a Tashkent address was listed as that of Mek Industrial Technology.

Clark Hill’s Facebook post showing Mark Ludwikowski (fourth from left) and Aleksey Khvan (second from left) during a November 2025 visit to New York by an Uzbek delegation that included the governor of the Tashkent region, Zoir Mirzayev (sixth from left).

Contacted for comment, Aleksey Khvan told a reporter he had reached “the wrong Aleksey.” Asked whether his father is Grigoriy Khvan, he paused and said: “No he’s not. Grigoriy who?”

Grigoriy Khvan did not respond to written requests for comment, nor did Choy, the listed shareholder of the three Singaporean winners of AMMC tenders.

Alexandra Li, Cathy Otten, and iFact contributed reporting. A Central Asian reporter who contributed reporting cannot be named for security reasons.