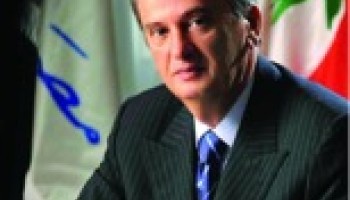

OCCRP and its Lebanese media partner, Daraj, last year uncovered a vast network of offshore companies tied to Salame, his family members and associates, including four registered in Luxembourg.

The first of two investigations into the governor, published August last year, uncovered Salame’s ownership of three companies in Luxembourg which owned nearly US$100 million in overseas assets.

Salame claimed that the source of his funds comes from his successful commercial banking career and inheritances, prior to working at the central bank.

Company accounts suggest tens of millions of euros in financing for the investments was sometimes secured without collateral. A fourth Luxembourg company owned by the governor’s brother loaned 17.2 million euros ($18.8 million) to a French property investment vehicle which acquired luxury real estate in Paris.

The second investigation, published in December, found that a company tied to Salame bought a stake in his son’s wealth management company, then sold it to a major Lebanese bank that he regulates.

Lebanon’s embattled central bank governor has continued to invest in valuable overseas properties during his country’s two-year economic meltdown that has plunged 74 percent of Lebanese into poverty, according to a recent U.N. analysis.

Fulwood Invest S.a.r.l., a Luxembourg company beneficially owned by Riad Salame and directed by his son, Nady Salame, in June 2020 bought a GBP 6.25 million (US$7.8 million) property in West London, according to records obtained by OCCRP. The asset earns GBP 320,000 (US$428,543.68) in annual rental income from commercial tenants, according to a chartered surveyor which valued the property.

The same company in December 2020 bought a GBP 4.9 million (US$6.5 million) property in the expensive Kings Cross area of central London.

Salame’s companies and assets span multiple countries across the globe, including Germany, Belgium and the U.K., as well as favorable tax havens, such as Panama, Liechtenstein and the British Virgin Islands.

Several countries are coordinating their prosecution efforts, according to Le Monde, which reported that last month, a number of European prosecuting authorities met in The Hague with the French and Lebanese prosecutors in charge of investigating Salame, to form a transnational investigative team to facilitate the exchange of information in the case.