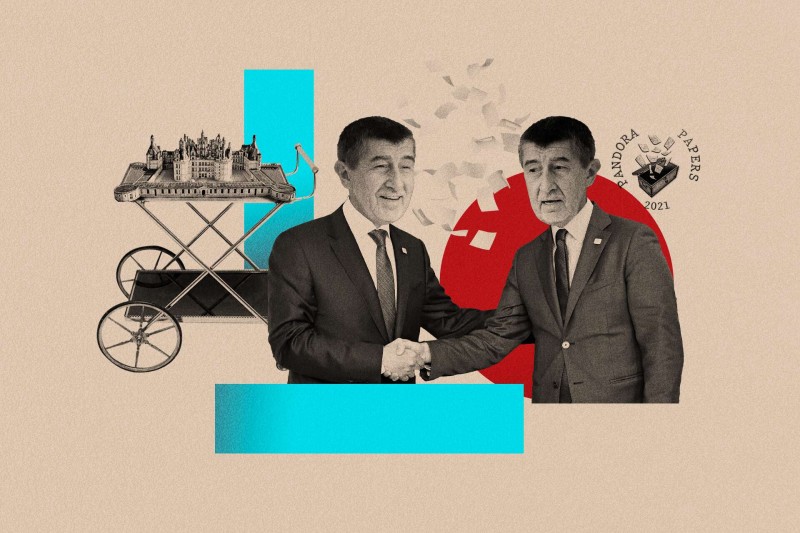

With elections in the Czech Republic just five days away, Prime Minister Andrej Babiš has pinned his reelection hopes on a populist platform built since 2013 on his vocal opposition to corruption.

The billionaire business magnate has positioned himself as a leader capable of cracking down on tax dodging and portrayed his ANO party as an anti-graft movement with zero tolerance for wrongdoing by its representatives.

Babiš has goaded rivals who have used offshore companies to evade public scrutiny. Shortly after the 2016 publication of the Panama Papers, based on a leak of offshore documents, he said: “I think everyone who does business knows that Panama is not exactly a territory where they do business transparently.”

But at the same time, Babiš was himself making extensive use of offshore jurisdictions, using them to move millions of euros through the international financial system and invest them in luxury French real estate, a new leak of offshore documents reveals.

The Pandora Papers, a massive leak from 14 corporate service providers obtained by the International Consortium of Investigative Journalists (ICIJ), show how Babiš set up shell companies in Monaco, the United States, and the British Virgin Islands, a jurisdiction ranked as the world’s most opaque corporate tax haven by the Tax Justice Network advocacy group. Panama did not even make the top 25.

In 2009, Babiš sent 15 million euros to a shell company in the British Virgin Islands that had just been set up for him. That money appears to have been invested in the French Riviera, including a chateau just outside Cannes. But how it got there wasn’t straightforward.

Leaked documents suggest the prime minister may have used the same structures he publicly criticized to conceal how he purchased the properties, experts say. While it is not clear why Babiš chose to arrange the purchase in such a roundabout way, three financial crime experts said the set-up was most characteristic of money laundering.

“The whole scheme does not make economic sense,” said Kamil Kouba, a former financial crime investigator and currently an expert on AML prevention. Kouba suggested the arrangement was designed to conceal the source of the money.

Offshore companies are sometimes used by wealthy clients to maintain privacy or legally lower their tax burden, but experts said Babiš’s network did not seem to fit that pattern.

German tax expert Christoph Trautvetter pointed out that value-added tax (VAT) and other fees are paid where the real estate is located, meaning France in Babiš’ case. “As I understand from the documents, they paid the VAT and they paid quite a lot,” he said.

Using an offshore shell company would not help Babiš avoid French wealth tax, Trautvetter added.

Investigace.cz reporters asked Babiš about his offshore business, but he refused to respond.

Babiš’ Previous Controversies

The Scheme

In July 2009, French lawyers approached an offshore corporate services provider called Alemán, Cordero, Galindo & Lee (also known as Alcogal), to set up a company in the British Virgin Islands on Babiš’s behalf.

The company, Blakey Finance Limited, was incorporated in August 2009 and the following month received a 15-million-euro cash injection from Babiš.

The Pandora Papers show that Blakey Finance almost immediately agreed to send the funds to Boyne Holding LLC, a company incorporated in Washington, D.C., and then on to Boyne Holding’s Monaco-registered subsidiary, SCP Bigaud. The money was marked as a 10-year, four-percent loan for real estate investment.

This “back-to-back loan,” as it is called in the documents, was for the purchase of 16 properties in the Riviera commune of Mougins, including a chateau used as a summer residence.

According to two Blakey resolutions from 2013, the company secured approval to use its assets — which appear to be its 15-million-euro claim on the French properties — to secure two loans from Société Générale Private Banking in Monaco for a total of 12 million euros.

“[Babiš] has ended up buying a chateau with money of potentially suspicious origin and in the process generated a loan from a respectable bank that he can invest anywhere without any great problem,” said Graham Barrow, a financial crime consultant. “Any bank will accept those funds. Since it’s a loan from Société Générale, the assumption would be that it has gone through a full due diligence process.”

Babiš’s connection to Boyne Holding and SCP Bigaud is relatively easy to prove: The Pandora Papers show that he owned Boyne himself, while SCP Bigaud was part of his trust fund from 2018 until it was dissolved in 2020. But Babiš’s ownership of Blakey Finance was hidden by British Virgin Islands secrecy laws, obscuring the fact that he was effectively loaning these funds to himself.

This arrangement would “give the impression that the purchase of real estate was made with money borrowed from a legitimate source,” said former police investigator Kouba.

“This scheme is a textbook example of money laundering,” he said. “This is how criminals who need to launder money do it.”

Alcogal did not comment on the services it provided to Babiš. In an emailed response to the ICIJ, the Panamanian firm said that it “duly complies with all laws in the jurisdictions in which it operates” and does “not provide any type of tax advice.”

Reporting by investigace.cz turned up further irregularities. When reporters visited SCP Bigaud’s Monaco address, they found the small office of a formation agent, a type of company which sets up other companies and handles their post and paperwork. Although SCP Bigaud listed this Monaco address until it was shut down, the agent told reporters that it had not been registered there since 2009, and said the company’s contract had been terminated after it failed to pay its fees. “They shouldn’t be using this address,” the agent said.

The loan agreement between Blakey Finance and Boyne Holding was also missing some standard clauses and terms, including collateral and interest on arrears.

Even more unusually, Blakey Finance was liquidated four years before the loan was due. This was especially notable given that the loan was to be repaid in one sum in 2019, rather than in tranches. The liquidation documents from the British Virgin Islands did not note any outstanding debts or claims and did not say what would happen to any debt that did exist after liquidation.

Cote d’Azur Properties

The picturesque center of Mougins, seated on a hilltop overlooking the French Riviera, is accessible only by a narrow, winding road.

Branching off this road is an even smaller street, Chemin de la Mougine, where a row of high walls and hedges shields several Babiš properties from view.

The first is a well-maintained plot, featuring a manicured green lawn and several palm and olive trees. A little further down the road lies the most spectacular of the properties, the Chateau Bigaud, which is used as a summer residence by the Babiš family. The Czech prime minister’s wife Monica has not been able to resist flaunting it on Instagram, where she has posted pictures of herself with friends and family in the swimming pool in front of a spectacular view of the seashore.

Further along Chemin de la Mougine is another of Babiš’s properties: a villa with a beautiful garden surrounded by a fence, but visible through some patchy hedges. The two gardeners there told investigace.cz they have no idea who their employer is, but said they think that “the house next door [Chateau Bigaud] is owned by some Czech people.” Other neighbors also said they had not heard of Babiš.

The next property, which is not visible from the main street, is the only one that gives some outward sign of Babiš’s ownership. A bell on the gate features the name ‘IMOREP IMODIM EXOREP’ and a mailbox lists several Czech names.

I.M.O.R.E.P. and EXOREP are openly owned by Babiš’s private trust and were previously owned by Agrofert, the company that made Babiš a billionaire.

I.M.O.D.I.M. first appeared in a 2018 annual report for Babiš’s company SynBiol, where it was listed as an owner of SCP Bigaud. When reporters rang the bell and asked whether the property belonged to Babiš, a voice on the other end said, “He’s not here,” and hung up.

EXOREP also ran a restaurant, called Paloma, located back uphill toward the town center. Babiš has written with pride on social media about its Michelin stars and shared photographs of its elaborately plated food. But the establishment has been closed since October 15, 2019. The building is now deserted, with the menu showcase empty and only a couple of dry palm leaves on the patio.

Hidden Assets, Political Ambitions

By incorporating Blakey Finance in the British Virgin Islands, Babiš was making use of what is considered to be one of the most opaque corporate jurisdictions in the world.

The tiny Caribbean archipelago provides only scant details about the thousands of shell companies set up by corporate service providers there each year. Late last year, Premier and Minister of Finance Andrew Fahie said the territory would introduce publicly available registers of the true owners of the more than 400,000 active companies registered there, but it has yet to do so.

Reporters Refused Entry to British Virgin Islands

Babiš appears to have been reluctant to be publicly linked to Blakey and its funds: He did not declare his ownership of the company — or his shares in Boyne and SCP Bigaud — in obligatory asset declarations between 2013 and 2015.

Public officials are obliged to list any shares in business corporations and any immovable properties that they owned “on the day preceding the commencement of the performance of [their] function,” said Lukáš Kraus, a Czech lawyer at the non-profit law firm Frank Bold.

“Failure to list shares is a misdemeanor under the Conflict of Interest Act,” said Kraus.

Yet Babiš was open about his ownership of the chateau. In 2018, while serving as prime minister, his company SynBiol listed SCP Bigaud (and therefore the French properties) as an acquisition in its annual report.

As Babiš’s political star began to rise, so did his obligations to disclose his assets — even in the notorious tax haven. According to British Virgin Islands law, his new status as a public official required compliance officers at Alcogal — the service provider that set up Blakey Finance — to review the risks of keeping him as a client.

As the EU subsidy fraud swirled in 2016, Alcogal filed a formal ‘Suspicious Activity Report’ about Babiš with the British Virgin Islands Financial Investigation Agency.

But the service provider’s suspicions seem to have been raised even earlier. On an assessment form dated October 1, 2014, Alcogal officers were asked whether they had come across negative information about Babiš or his company officers and whether any of them were “known to be or suspected of any criminal or suspicious activities by any regulated authority.”

They marked “yes” to each.

.jpg/daf5f209c20846c8dcd2295cae2a00ae/kenyan-aladdin-sep24-(1).jpg)