Dr. Robert Wallner, Liechtenstein’s chief prosecutor, declined to provide further details.

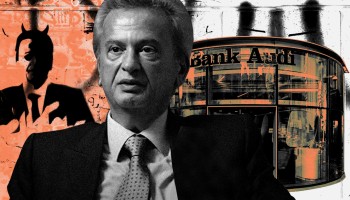

Confirmation that a fourth European country is probing Salame comes only days after Luxembourg confirmed it had opened a criminal case into Lebanon’s embattled central bank governor following previously announced investigations in Switzerland and France.

Those investigations are looking at allegations of money laundering and possible embezzlement involving countries where Salame owns companies, properties or other assets.

European investigations into Lebanon’s central bank governor come amid a period of economic collapse in once-stable Lebanon which some attribute to Salame’s management of the central bank.

According to a U.N. analysis published in September, poverty in Lebanon has “drastically increased” during the past year and now affects 74 percent of the population.

Salame has repeatedly denied any wrongdoing and said he had demonstrated that his wealth had been acquired before he took up his central bank post in 1993.

In a press release published Wednesday citing “relentless attacks against [his] person,” Salame said he had asked a “first rank and renowned audit firm” to review investments and transactions during his term in office, as well as his personal accounts.

According to him, the unnamed audit firm concluded that his accounts have not received funds from the central bank. Investments “were made by me personally with funds coming from my personal accounts,” he said.

Salame has not published the audit report but said it would be submitted to judicial authorities.

OCCRP and its Lebanese media partner, Daraj, last year published an investigation into Lebanon’s central bank governor that uncovered his overseas investment assets valued at nearly US$100 million.

A second investigation found that a Panama-registered company tied to Salame bought a stake in his son’s wealth management firm, then sold it to a major Lebanese bank that he regulates.

That company, Crossland Assets Corp., was moved to Liechtenstein in 2018 and renamed Crossland Limited. It reported $42.8 million in cash assets and $1.8 million in portfolio investments in December 2019, documents obtained by OCCRP show.

Crossland’s shares were owned by the Liechtenstein-based Salamandur Trust reg., which is not required to disclose its ownership publicly.

The directors of Crossland and Salamandur – trust professionals based in Liechtenstein and Switzerland – were once shareholders in a Swiss trust business involved in a tax evasion scheme that led to a record $2.6 billion fine in the United States.

OCCRP asked Salame three times if he held an interest in Crossland.

“We fail to understand this question,” he said through his attorney.