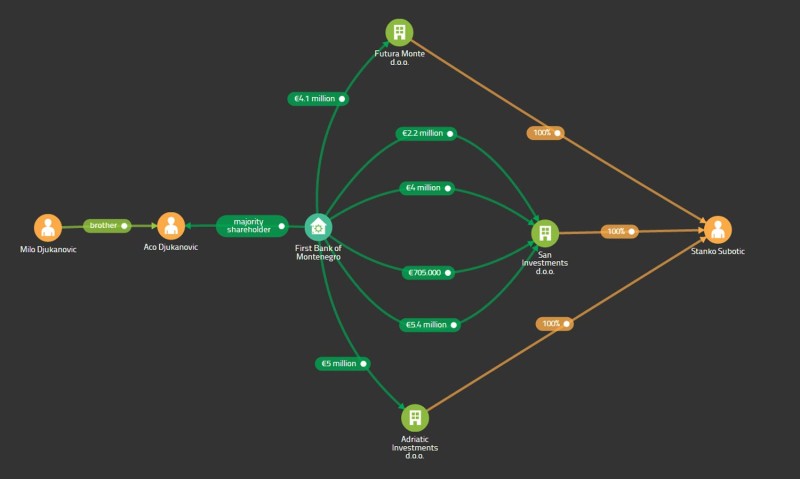

Serbian businessman Stanko Subotic tried to turn Montenegro into the new Monaco by buying the choicest coastal property and promising luxury resorts. But to do it he borrowed almost €21 million (US$ 30.66 million) from the Prime Minister’s family bank – loans that were often not secured and required lump sum repayments. As the single largest debtor to the bank, it put both him and the bank in a precarious position. If he were to fail, he would bankrupt himself and maybe the bank -- a bank that held huge amounts of government money.

Subotic’s loans made the Central Bank, Montenegro’s chief regulator, nervous.

And they had good reason to be so.

Bad Loans Backfire

Between 2007 and 2010 the Central Bank sent six teams of top-notch examiners and hired auditor PricewaterhouseCoopers (PwC) to look into the operations of First Bank.

They found a lot.

Seven secret reports OCCRP obtained show that the family bank repeatedly broke the law and approved loans against its own policy and in violation of good banking practice to benefit a number of Djukanovic’s business partners, relatives and friends. Some of the biggest violations included the loans to Subotic’s companies.

At the time the first loan was approved, Subotic’s San Investments was newly formed and had no income, or business plan, which are basic requirements for banks to even consider a loan. And it approved a long grace period before making any payment due.

Other San Investment loans also were problematic, and some even allowed lump sum payment at maturity. First Bank kept poor documentation and could provide no evidence for its claim to examiners that San’s loans were secured with deposits.

While fully aware the total value of loans given to San Investments by far exceeded the allowed limit - 25 percent of bank's own capital – the Djukanovics' bank hid this information from examiners to avoid sanctions.

In one instance, the bank said it had given only one loan to San Investment, while examiners found four. On a number of occasions, the Central Bank ordered First Bank to stop its risky practices and comply with the law.

It did not.

With millions locked up in bad loans, in January 2008 the bank started experiencing liquidity problems. At the same time, international markets were roiling and international stock markets started a decline that would wipe out one third of their value. The Great Recession was starting and investment money dried up overnight. Real estate prices went into freefall. By the spring, First Bank was in serious trouble and unable to honor withdrawal requests from depositors. Much of the government money loaned out to Djukanovic’s friends had been lost.

On April 28, 2008, Subotic was arrested at Moscow’s Sheremetyevo Airport. Despite Interpol’s Red Notice, he had had no problems getting a visa. Serbia requested his extradition, but Russia refused and two months later, on June 26, Subotic was released.

Help from a Drug Lord

At the time of his release, San Investments had at least €7 million (US$ 11 million) in its account at the First Bank.

But by the end of October 2008 this collateral was replaced with a new one of €4.2 million (US$ 5.9 million). According to a Central Bank report, the new money came from Lafino Trade, a Delaware-based company owned by bothers Dusko and Darko Saric. Darko Saric led a powerful Balkan criminal organization which had for years trafficked cocaine from South America into Europe. He is charged in Serbia with smuggling more than five tons of cocaine and laundering more than €20 million (US$ 27.6 million).

Media in the region have long speculated on a connection between Saric and Subotic. In a September 2009 letter to the Argentinian Federal Police, the US Drug Enforcement Administration (DEA) identified a person named Stanko Subotic as a member of Saric's criminal organization. DEA would not return requests to confirm the identity.

Subotic in a later interview said he knew Saric but never did business with him. The Central Bank report is the first public evidence of an association.

Fall of an Empire

Subotic had borrowed from First Bank for a variety of businesses. While San Investments continuously failed to repay its loans, another of Subotic's companies, Belgrade-based Futura Plus, a huge kiosk chain and media distributor, applied in mid-September 2008 for a tender to privatize Duvankomerc, a Montenegrin tobacco retailer. Despite offering just €2.1 million (US$ 2.9 million)—another bidder offered three times as much—he won the bid. After several delays in signing the contract, on Nov. 10, 2008 his company withdrew from the privatization.

Subotic’s companies and the bank were broke.

Two weeks later, the Djukanovics' bank asked the government for a €44 million (US$ 56.7 million) short-term liquidity loan to save the bank. Not only had the Djukanovics' cash machine for the privileged run out of funds, it owed €32 million (US$ 41.2 million) to creditors and depositors.

The bailout was granted on Dec. 11. Montenegrin citizens picked up the tab for First Bank’s transgressions. While the bank claims to have repaid citizens, OCCRP found that is in doubt.

They might not have needed to.

First Bank allowed Saric, Subotic and others who were responsible for the bank collapse to withdraw their deposits—the very deposits which should have secured their loans.

The move was just another example of the strong interconnected business relationships between Saric, Subotic and Djukanovic.

In January 2009 examiners wrote that the bank did not collect money from deposits, "despite the fact it would be (by far the) easier and faster way to collect the debt." The Central Bank demanded First Bank liquidate its bad loans and collect on the collateral, much of which was of questionable value especially when it involved loans to powerful people.

The government bailout loan did not solve the bank’s problems.

On Feb. 1, 2009, the First Bank announced it was selling Subotic's island for the starting price of €28 million (US$ 35.9 million). One day later Samuelson Corporation issued a press release stating it was withdrawing from Montenegro, blaming its inability to obtain necessary permits. Debt was never mentioned.

Under pressure from the Central Bank, the property was put up for auction. The first auction failed. Two more followed and also failed. No one publicly expressed interest in buying Subotic's land.

But behind the failed auction, a secret deal was being set up to that avoided future auctions of the valuable land.

Another Prime Minister Enters the Picture

On March 17, 2009, the Central Bank called for the government to take over First Bank which it said needed €110.6 million more just to stay alive. The bank along with its biggest depositors and debtors, the most powerful people in the country, were in serious financial troubles. They looked outside.

On April 20, 2009, Thaksin Shinawatra, former prime minister of Thailand, arrived in Liberia holding a Montenegrin passport. It was a difficult period in Shinawatra’s life. He had been removed from office in a 2006 coup and went into self-imposed exile. But Shinawatra had been facing more difficult problems -- five days earlier his Thai passport had been revoked.

According to Montenegrin law, a person may be granted citizenship in Montenegro as long as he or she has not been sentenced to a prison term. However, Shinawatra had been convicted in absentia for corruption, and Interpol had issued a warrant for his arrest. He got citizenship anyway.

The records show that at this very time when Interpol was looking for Shinawatra, €15 million (US$19.8 million) of Shinawatra’s money ended up in First Bank, deposited by a lawyer from Dubai named Khalid M. Kadfoor Al-Mehairi. Montenegrin officials refused to answer questions about how his citizenship was approved or by whom.

The money was vital for First Bank which was in its most critical state, with no cash or way out, and the Central Bank was calling for its liquidation.

Al-Mehairi never filled out a form that banks are obliged to complete for all depositors. A year and a half later, court records revealed that the lawyer made the deposit on behalf of Shinawatra.

According to court records, Shinawatra, who had made money selling his Manchester City football team, had asked the lawyer to do a number of business transactions for him. These included buying a house in Dubai, and opening an account in his name in a bank in Montenegro.

Due to the Interpol warrant which was still outstanding, Al-Mehairi convinced Shinawatra to open the account in Al-Mehairi’s name rather than Shinawatra’s so the money couldn’t be seized. Later Shinawatra’s conviction and warrant would both be withdrawn.

Al-Mehairi deposited the money in April 2009, but the arrangement did not end well.

Shinawatra later accused the lawyer of embezzling the money. Eventually Al-Mehairi was acquitted of embezzlement and forgery, but convicted of breach of trust and sentenced to three years in prison.

The €15 million put Shinawatra among the bank’s top five depositors in 2009.

Auditors from Pricewaterhouse asked about the mysterious deposit at the bank. The bank finally showed them a letter from Al-Mehairi authorizing the use of those funds as cash collateral for a loan to San Investments.

As of Sept. 30, 2009, Subotic’s companies owed €17.3 million (US$ 25.3 million) to the First Bank. On that day the bank and San Investment signed an agreement dividing the debt into two loans – €2.3 million and €15 million. The second, larger loan was to be secured with the Al-Mehairi deposit, which meant that Shinawatra’s money could be used to pay off the loan, but a very unusual proviso was added. The bank could only seize the collateral with the written consent of Al-Mehairi.

In February 2010, First Bank informed the Central Bank that San Investment’s €15 million debt—intended to pay for the island property and to fund several other ventures--was paid off with Al-Mehairi’s cash collateral.

But the Central Bank reports indicate that First Bank gave wrong information to regulators on numerous occasions especially about accounts involving privileged persons and often relating to collateral. Central Bank regulators repeatedly admonished the bank for missing, incomplete or contradictory paperwork.

Al-Mehairi should have owned the land if his collateral had been used to pay off the San Investment loans but records show the Djukanovics' bank still retains the mortgage to this day. That fact raises the question of whether this was just another paperwork shuffle used to deceive the Central Bank.

Mysterious Buyers

Subotic by late 2009 had lost or sold almost all of his assets in Montenegro.

The Djukanovic government granted him one more favor. His property had been seized by the Supreme Court in Belgrade. But the Montenegrin authorities cancelled the court’s decision so that Subotic could take back control and transfer his personal assets (including the Villa Montenegro and other properties) to Manola Management. This company is registered in the British Virgin Islands, an offshore jurisdiction which allows hidden ownership.

On Nov. 25, 2009, the Djukanovics' bank took ownership of the plot of land near the Villa Montenegro, a move intended to satisfy the Central Bank which had ordered First Bank to cut its losses by selling the assets of debtors who were not making payments on their loans.

The Djukanovics' bank helped again. According to the unusual agreement, if First Bank ever decides to sell that plot, it must give Subotic the first chance to buy it back.

A month later, the Samuelson Corporation transferred its ownership of San Investments to Velo Business Services, a company incorporated in the British Virgin Islands just two months earlier. The price was €11 million, the same amount that Samuelson has loaned San Investments in the first place.

A year later, San Investments again changed hands and again for €11 million, this time to the Panama-based Adriatic Overseas Holdings. The true ownership of both companies remains hidden behind lawyers and proxies.

One person knows the truth. Before taking over San Investments, the company that registered Adriatic Holdings sent a power of attorney letter to Petar Ivanovic, Djukanovic's confidant, fellow board member, and his Minister of Agriculture and Rural Development. The power of attorney authorized lawyer Zorica Djukanovic (no known connection to Milo Djukanovic) to act on behalf of the company. Zorica Djukanovic has represented, among others, Aco Djukanovic, the president’s brother, the Dudic family and Jovica Loncar, a Saric associate.

Ivanovic and Subotic refused an interview with OCCRP.

In October 2011, Subotic was sentenced in Serbia for abuse of office to six years in prison. He appealed, and the court ordered a retrial which is ongoing.

In the end, the property’s new owner is not known but it is still connected to Saric and Djukanovic, the people of Montenegro paid off the losses for Subotic’s bad investments and the head of the Central Bank which tried to regulate was replaced with an official from First Bank, the bank at the very center of the deal. What new deals are happening are not known.

And Montenegro’s Hawaii remains undeveloped.

Contributed by Dejan Milovac (MANS), Stevan Dojcinovic (CINS), and Lejla Camdzic (OCCRP).