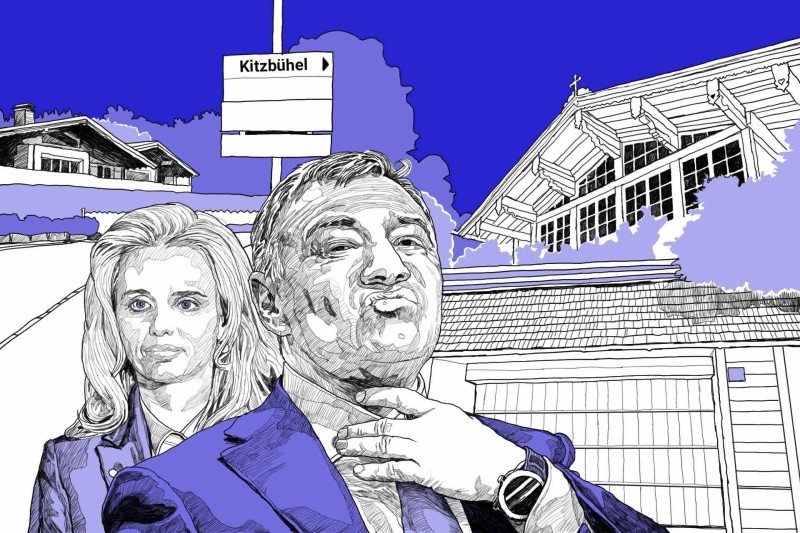

Sitting behind a wooden gate and a high spruce hedge, the two-story house on a quiet street blends easily into the upscale Austrian ski town of Kitzbühel. But locals say this typical Tyrol-style home has hosted some high-profile visitors: The eldest daughter of Russian President Vladimir Putin, her former partner, and possibly even Putin himself.

Reporters from OCCRP’s partners, Paper Trail Media and Der Standard, visited Kitzbühel last month, and spoke to multiple long-term residents. Half a dozen said they had heard the family frequented the house. Two said they had seen Putin himself around the house.

"They probably were the best neighbors you could wish for,” said a person who knows Kitzbühel well. “They were quiet, and one felt safer than ever."

It was impossible to verify these claims. But a leaked email archive obtained by IStories and OCCRP suggests that the house had been bought by an offshore company using a well-concealed loan from Arkady Rotenberg, a childhood friend of Putin’s who was sanctioned by the U.S. and the EU in 2014 after Russia’s annexation of Crimea.

“It is well known that oligarchs close to the Kremlin, such as Putin’s childhood friends the Rotenbergs –– who made their fortunes from state contracts –– return the favor by sponsoring a life of luxury for the Putin family,” said Florian Horcicka, an author and expert on dirty money in Austria.

On paper, the property is owned by a Cypriot company called Wayblue Investments Limited, which purchased it for 10.8 million euros ($14.4 million) in January 2013. Who owns Wayblue is a mystery: No beneficial owner is named in the leak, and Cypriot registry documents since 2015 list a company called Velidom Ltd. as its only shareholder. It’s not clear who is behind Velidom either.

When contacted by reporters, Austrian authorities said they had looked into the ownership of the house but were unable to advance their 2022 investigation.

“The suspicion that this property is in the possession of a sanctioned person could not be substantiated to date,” said Harald Sörös, a department spokesperson of the Ministry of Interior. “Should new evidence be found, we will submit a report to the relevant authorities.”

Arkady Rotenberg did not respond to questions.

Reporters obtained land documents from the Netherlands and Cypriot corporate records that suggest that the residents of Kitzbühel are right in believing the house was owned by either or both Putin’s older daughter, Maria Vorontsova, and Jorrit Faassen, a Dutchman widely reported to be her former romantic partner.

Hidden Loan

Paperwork contained in the leaked archive demonstrates the careful methods used to hide the purchase. The emails show a plan to funnel money via a loan from a Latvian bank owned by Arkady Rotenberg and his brother through Arkady's Cypriot company, Olpon Investments Limited.

About The Rotenberg Files

The Rotenberg Files is an investigative project based on a leak of over 50,000 records, including nearly 30,000 emails and some 12,000 documents, that shed light on how Russia’s most infamous oligarchs, the Rotenberg brothers, dealt with being sanctioned by the West.

A draft agreement from 2016, found among the leaked documents, shows that, in January 2013, Olpon had agreed to place 11.5 million euros ($15.4 million) under the management of the Rotenbergs’ SMP Bank. The agreement said SMP invested the funds by providing it as a loan to the newly-formed Wayblue. That same month, Wayblue purchased the Kitzbühel house using the loan, according to Wayblue’s 2013 financial statements.

"It is almost obvious that the flow of money is to be concealed,” said Stephan Blancke from the London-based think tank, Royal United Services Institute (RUSI). “Why else would this construct be chosen?"

In mid-2014, Rotenberg sold SMP to its management team and it was renamed Meridian Trade Bank. Then, according to the 2016 document, Meridian Trade Bank transferred the management of the loan to the Estonia-based Cresco Securities. The principal of the loan had not been repaid by Wayblue.

Cresco’s owner, an Estonian businessman named Olev Schults, confirmed that his company took over managing the investment but ended the arrangement in 2021. Schults said he knew Rotenberg was behind Olpon but denied working with any sanctioned individuals or companies. The current status of the loan is unknown.

Schults said he knew the identity of the real owners behind Wayblue, but declined to disclose their names.

There was no reply to questions emailed to addresses for Wayblue and Olpon. An Austrian lawyer representing Wayblue declined to comment.

Tom Keatinge, director of the London-based Centre for Financial Crime and Security Studies at RUSI, said the convoluted house purchase is typical of deals by those seeking to hide the trail of wealth.

Although Rotenberg was not sanctioned until the year after the purchase, he would have suspected he was “in the crosshairs,” Keatinge added.

“These individuals think ‘I come up in the press often enough as someone who people think should be sanctioned, so I’m going to structure my life in a way that mitigates that risk,’” he said.

A Cross-Border Paper Trail

While the Kitzbühel purchase may have been purposefully convoluted, another property deal 760 kilometers northwest created a paper trail leading to Faassen, reportedly the former romantic partner of Putin’s daughter, Vorontsova.

A few months after Wayblue Investments bought the Austrian house in January 2013, another Cypriot company called Gietrin Investments Limited set up a Dutch company called Molenkade Ontwikkeling B.V. and purchased a plot of land outside of Amsterdam.

Like Wayblue, Gietrin’s real owners are a mystery.

The companies have several things in common. Gietrin and Wayblue both banked at the Rotenbergs’ Latvian SMP Bank, used the same tax accountant, and were registered on consecutive days, according to financial statements filed in Cyprus.

But the connection goes deeper. Financial documents for Wayblue, obtained from Cyprus, show that Gietrin loaned Wayblue 750,000 euros ($815,000), and was referred to as a “related company.” In legal terms, related party relationships mean that one company has control, joint control, or significant influence over the other — for example having the same or overlapping shareholders or one company being a subsidiary of the other.

Though the Cyprus paper trail ends there, Dutch records reveal that the husband of Faassen’s cousin was the director of Gietrin’s Dutch subsidiary, Molenkade, until Faassen replaced him in 2019 and sold the land plot — Gietrin’s only asset — to himself in September, after his relationship with Vorontsova had ended. He dissolved Molenkade later that month.

In May 2023, the Dutch Public Prosecution Service seized the land. The reason for the seizure is unknown.

Taken together, the evidence raises the question of whether Faassen or Vorontsova were the real owners of one or both companies.

Neither Faassen nor Vorontsova responded to emailed questions.

The answer might not be known, but the accounts of Kitzbühel residents lend additional supporting evidence. Two locals described seeing cars with Dutch license plates at the property, and four recalled a Dutchman staying there.

One former neighbor told reporters that a woman named Maria was regularly at the house.

“Her husband, a Dutchman, was often there,” the neighbor added.

Additional reporting by Carina Huppertz, Frederik Obermaier (Paper Trail Media), and Holger Roonemaa (Delfi Meedia)