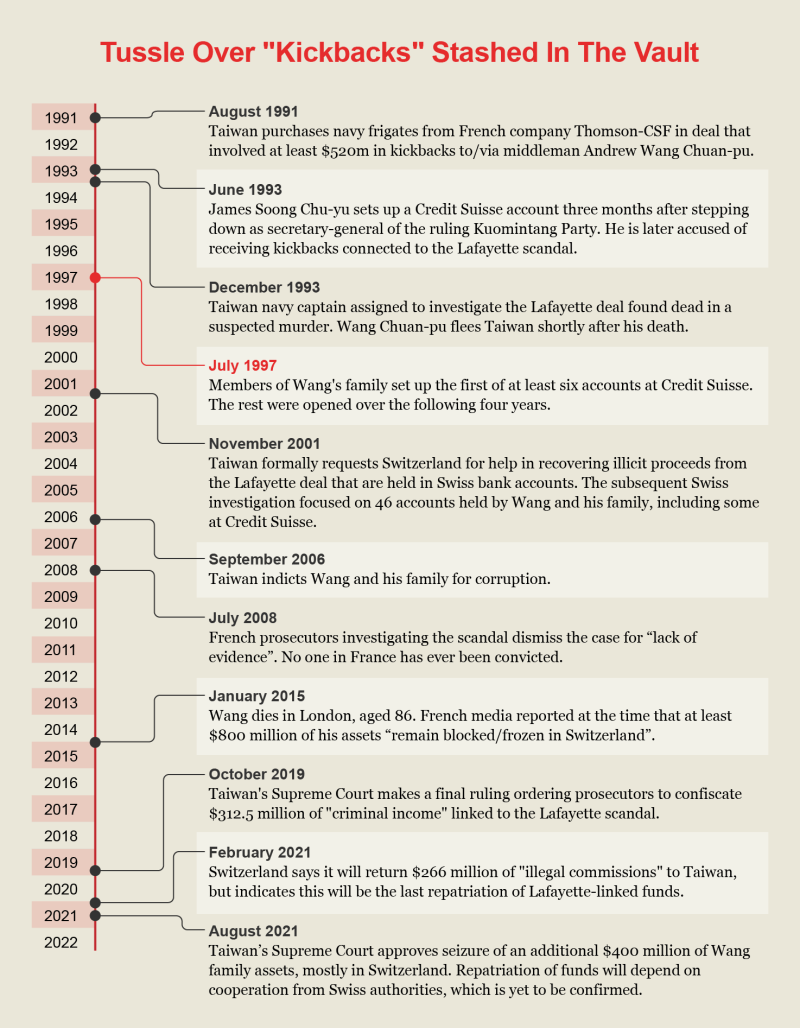

Three decades after Taiwan purchased six La Fayette-class navy frigates from a French state defense company, the fallout is still being felt on opposite sides of the world. In February 2021, Switzerland agreed to return $265 million in “illegal commissions” on the deal that were stashed in Swiss bank accounts, and Taiwan is seeking hundreds of millions more.

The so-called Lafayette scandal is one of the largest naval contracting corruption schemes in modern history. Some $520 million was paid out in kickbacks to senior officials in Taiwan, France, and mainland China, according to court testimonies. There was even a spate of suspicious deaths of people appointed to investigate the scandal.

Now, records from Suisse Secrets, a global investigation coordinated by OCCRP and based on banking data leaked to Süddeutsche Zeitung, reveal an undisclosed account at Credit Suisse belonging to a high-profile Taiwanese politician that sheds new light on the case.

The Suisse Secrets Investigation

Suisse Secrets is a collaborative journalism project based on leaked bank account data from Swiss banking giant Credit Suisse.

The account belonged to James Soong Chu-yu, who was the secretary general of Taiwan’s ruling Kuomintang (KMT) Party at the time the contract for the frigates was signed. Soong was accused of taking kickbacks from the Lafayette contract by a French politician, but was never charged in relation to the case.

Soong is still active in Taiwanese politics today. He left the KMT in 1999 and formed his own political party, and has run for president — unsuccessfully — in nearly every election since 2000.

Soong’s Credit Suisse account was opened in June 1993, three months after he had stepped down as KMT secretary-general, and closed in 2010, the leaked banking data shows. Its maximum recorded balance was over 13 million Swiss francs ($11.18 million) in 2007 — wealth that cannot be explained by his official salary as a public servant.

Renaud Van Ruymbeke, a former judge who led the French probe into the Lafayette scandal, told Le Monde he was not told of Soong’s Swiss account by Swiss authorities. If its existence had been known at the time, he added, it could have had an impact on a 630-million-euro arbitration case between France and Taiwan that was heard in 2010.

“The investigation that I conducted in France was deprived of crucial information,” Van Ruymbeke said. “It could have shed important light on what was really behind this case.”

A source close to the case, speaking anonymously because he is not allowed to speak to the press, told Le Monde that Soong would have been the subject of an investigation into the source of his funds if his account had been flagged.

Reporters also discovered accounts belonging to relatives of the key middleman in the corrupt frigate sale, Wang Chuan-pu, also known as Andrew Wang. All of the accounts were opened between 1997 and 2001, although Wang’s role in the deal had been made public in international media by March 1994. Major investigations and criminal proceedings had been initiated in France, Taiwan, and Switzerland by 2001.

Kharis Templeman, program manager for the Hoover Institution’s Project on Taiwan in the Indo-Pacific region, described the Lafayette case as “the peak…of corrupt dealings” between the KMT party, the government, and the private sector. He said it was clear Soong was “directly involved” with the bribery scandal, and it was unlikely that the money in his Credit Suisse account came from his salary as a lifelong public servant.

“What’s new here is the strong circumstantial evidence linking Soong and Wang together, and proof that Soong maintained overseas bank accounts well into the 2000s, while he was still playing a king-maker role in Taiwan politics,” said Templeman.

A secretary at Soong’s People’s First Party told reporters Soong had no comment to make about his Swiss account. The party office also forwarded a 2003 statement in which Soong refuted claims he had taken bribes and insisted he was a staunch opponent of the Lafayette deal. Taiwan’s Presidential Office, currently controlled by the Democratic Progressive Party, declined to comment.

It is unclear whether Credit Suisse told authorities about Soong’s account once the Lafayette scandal became public. Switzerland’s Federal Office of Justice, the agency dealing with Taiwanese requests for assistance in tracing the stolen funds, said it had no record of Soong’s name in its files. Taiwan’s Ministry of Justice said it also had no prior knowledge of his account.

Still, experts said Soong’s political profile meant any Swiss account in his name should have been subject to enhanced scrutiny.

In an emailed response, Credit Suisse declined to answer specific questions, saying it was aware of its responsibility to adhere to the “highest standards”, it operates in compliance with all laws and regulations at home and abroad, and it had taken measures to combat financial crime in line with Swiss financial reforms.

“These media allegations appear to be a concerted effort to discredit the Swiss financial marketplace, which has undergone fundamental changes since the global financial crisis,” the bank added.

Wang was wanted in Taiwan for money laundering, corruption, fraud and murder, and international warrants were issued for his arrest, but he fled the island in the aftermath of the scandal and stayed in exile in the U.K. until his death in 2015.

His wife and eldest son were also indicted for receiving kickbacks, but in 2019 the Taiwanese Supreme Court found that, as third parties, they could not be convicted of that crime, even though they had received criminal proceeds. Years before the Supreme Court ruling, Taiwanese authorities issued international warrants against them for money laundering, and Bruno Wang and his mother remain on an official Taiwanese wanted list. Today, records show they own luxury properties in the U.S. and U.K., where Bruno Wang rubs shoulders with Prince Charles and his sister is a high-profile socialite in the British film industry.

Wang said in court that payments from the Lafayette deal were above-board commissions. None of the Wangs have ever been convicted of any criminal charges, and the family has said it would not get a fair trial in Taiwan.

‘Unknown in Our Files’

Swiss court documents and reports from the Taiwanese prosecutors office and Ministry of Justice set out the details of the Lafayette bribery scheme and the long legal processes that have followed.

Wang, who was an agent for Thomson-CSF, the French company selling the frigates that is now part of state-backed defense contractor Thales Group, was at the center of the deal. Taiwanese prosecutors say he and his immediate family set up shell companies and Swiss bank accounts that received “illicit kickbacks.”

A 2001 news report said Credit Suisse had reported Wang’s account to Swiss authorities for unspecified suspicious activity.

A Swiss judgment said Wang was suspected of disbursing $400 million in bribes to Taiwanese officials. A further $100 million was allegedly paid to members of China’s communist party to ease any potential diplomatic tensions, since China was likely to oppose the strengthening of Taiwan’s navy.

A Taiwanese Ministry of Justice report claims Wang also leaked military intelligence to his French counterparts, arranged secret meetings to help French negotiators scoop their rivals, and sought to artificially inflate the overall contract price.

None of the documents mention Soong. But in an interview with Le Figaro in 2003, French former foreign minister Roland Dumas, who was convicted but acquitted of corruption related to the Lafayette case, says Soong received kickbacks as part of the deal.

Yet, it appears Taiwanese authorities did not ask their Swiss counterparts to look into Soong.

The Swiss Federal Office of Justice, which handled the Taiwanese request for help in tracing the Lafayette kickbacks, said Soong’s name “is unknown in our files.” Swiss anti-money laundering authorities declined to comment.

Taiwan’s Ministry of Justice said it was not aware of the existence of Soong’s Credit Suisse account, but declined to provide further comments.

The Lafayette scandal wasn’t the only corruption case implicating Soong at the time.

Taiwan’s former President Lee Teng-hui and other KMT members had accused him of embezzling millions of dollars of party funds and donations between 1991 and 1993. A 2000 court case claimed he hid the money in secret bank accounts in Taiwan, then paid it into his son’s bank accounts in the U.S.

Soong was charged with embezzlement and appeared in court over the following years, but a dispute over the nature of the funds meant he was never convicted. After the case was unsuccessfully revived in 2005, and again in 2010, the charges were eventually dropped.

“Given the accumulated evidence against Soong in this case, it is incredible that he has continued to be so prominent in Taiwan politics over the last 30 years. He has never suffered financial or legal consequences for his role in these scandals,” said Templeman.

Experts said that Soong’s high profile meant his account, which was only closed in 2010, should have been subject to extra scrutiny. Swiss laws mean Credit Suisse also had a legal obligation to immediately report clients with dubious backgrounds or funds to authorities.

“The law says immediately. This means promptly. You have to report to the authorities. If you do not do this, the authorities usually do not find out about this account or contractual relationship,” said Monika Roth, a lawyer and academic specializing in financial crime.

Graham Barrow, a U.K.-based anti-financial crime consultant, said Swiss banks were less likely to report suspicious clients at the time of the Lafayette affair. “In Switzerland in the 1990s, establishing sources of funds — regardless of their size or dubiousness — would have merely been a box-ticking exercise,” Barrow said.

Luxury Lifestyles in London

Switzerland began freezing suspicious bank accounts belonging to the Wang family in June 2001. By 2003, 46 of their bank accounts were blocked, according to a Swiss court judgment, which gave details of their opening and closing dates, and the signatories on each one.

The details of at least three accounts in Suisse Secrets match those provided by Swiss authorities, and the judgment indicates these Credit Suisse accounts were among those blocked. In total, almost $500 million of assets belonging to the Wangs were frozen.

The largest of the six accounts that the Wangs held at Credit Suisse in the leaked data recorded a largest balance of 83.9 million Swiss francs ($69.15 million), but it is likely that considerably more moved through them. Andrew Wang was a joint account holder of one of them; the rest are in the names of his wife and/or children.

This includes their eldest son, Wang Chia-Hsing, also known as Bruno Wang, who is a joint account holder on all six of the Suisse Secrets accounts connected to the family. His profile and photograph are on the Taiwan Ministry of Justice’s active “wanted list” of criminals, along with those of his mother.

Media reports suggest prosecutors in Taiwan had sought up to a life sentence for Andrew Wang and various jail terms for his family members, including his wife who is a co-holder of most of the accounts, but none have been convicted as they have fled the country.

Swiss court documents say Bruno Wang told bankers that his wealth came from inheriting his father’s oil trading, IT and real estate fortune — though they point out that his father’s declared income could not explain the huge sums in his bank accounts. In an affidavit in a 2013 court case in the Cayman Islands related to the Lafayette scandal, Andrew Wang said the money in the accounts came from the contract, but claimed the payments were legitimate commissions.

Andrew Wang fled Taiwan shortly after the death in December 1993 of a Taiwanese navy captain who had been assigned to investigate the Lafayette deal and was later wanted in connection with his murder. The navy captain was the first of eight suspicious deaths of people with reported links to the case.

The family eventually settled in London, where Taiwanese media reported Andrew Wang lived with his wife in a mansion near Hyde Park until his death in 2015. His wife and children have enjoyed a life of luxury in the U.K.

UK land registry and real estate records obtained by OCCRP indicate that Blue Water Limited, a Cayman Islands company controlled by Bruno Wang, owns at least two pieces of residential property in the heart of London’s exclusive Belgravia district. U.S. real estate records show Bruno Wang and his mother also purchased a house near Oakland, California in 2007.

Bruno Wang is the founder of ‘The Pureland Foundation’, a U.K. charity registered to an address in London’s prestigious Savoy Court. Pureland’s website describes Bruno Wang as a “philanthropist and cultural patron”. In 2019, he was photographed alongside Prince Charles at a Scottish mansion controlled by the Prince’s charitable foundation.

Andrew Wang’s daughter, Rebecca Wang, a joint holder on four of the six Suisse Secrets accounts, is a high-profile socialite and entrepreneur in the U.K. As well as running her own entertainment business, she is affiliated to the Academy Circle for the British Academy of Film and Television Arts (BAFTA) and to other prominent London museums and art galleries, according to her own online biography.

In October 2021 Taiwanese media reported that the family appeared to have vacated their prestigious residential addresses in London.

Bruno Wang has strongly denied wrongdoing and said the family’s wealth is not illicit or tainted by any criminal activity, and that the family had nothing to do with his father's dealings in Taiwan. Rebecca Wang did not reply to questions.

Taiwan’s Representative Office in the U.K. declined to comment on the Wang family’s whereabouts or on the Lafayette scandal.

Templeman said the Lafayette case had lingered for 30 years as a hangover from before Taiwan’s transition to democracy.

“Taiwan’s democracy has come a long way since the Lafayette bribery scandal, but it remains one of several corruption cases from the pre-democratic era that have never been fully resolved, and that does not get enough attention,” he said.

Mutual Assistance

Thirty years after the $2.5 billion deal at the heart Lafayette scandal, legal disputes over the stolen money continue to rumble on.

Criminal inquiries into the case in France were dropped in 2008. Judges and prosecutors were denied access to important documents connected to the affair on the basis of defense secrecy, Eva Joly, a renowned corruption prosecutor and judge in France, told OCCRP.

In 2010, the International Chamber of Commerce’s International Court of Arbitration ruled that Thomson had violated a key provision in the 1991 Lafayette contract by using a middleman who received commissions. The court made the company and the French government pay a $830 million fine to Taiwan after an unsuccessful appeal the following year.

Van Ruymbeke, the former French judge who oversaw the Lafayette investigation in France, said knowledge of Soong’s account might have led to a different outcome in the arbitration court.

“It was the French taxpayer who paid most of the [arbitration] bill. However, the Kuomintang was in power in Taiwan when the contract was signed. The information you reveal now could therefore have had an impact on the [penalty decision],” he said.

In 2016 Taiwanese prosecutors requested Swiss authorities freeze $970 million of the Wangs’ assets in Switzerland. This included the already frozen funds in the 46 accounts, plus an estimated $486 million of interest, according to a Swiss court document. The Wang family argued in court that Taiwan has already received enough compensation and is fighting the request.

Swiss authorities said the process of helping Taiwan find and seize the illicit funds, known as mutual legal assistance, was closed following the February 2021 decision to return $266 million to Taiwan. Despite this, in August 2021 Taiwan’s Supreme Court reportedly issued instructions for authorities to recover over $400 million in additional frozen funds.

Taiwan’s Ministry of Justice indicated the repatriation process was ongoing, while the Ministry of Foreign Affairs and Ministry of Defense declined to comment.

Editor’s Note: After publication and through his attorneys, Bruno Wang disputed the article’s presentation of the legal facts surrounding the Lafayette deal and the description of his father’s alleged involvement in criminal activity.

Correction: An earlier version of this story misstated the relationship between Bruno Wang and a high-profile socialite in the British film industry. She is his sister. It also mischaracterized the status of Andrew Wang's legal situation. He was wanted by Taiwanese authorities for money laundering, fraud, and murder. OCCRP regrets the errors.

Clarification: This story has been edited to clarify the account of the decision of the Taiwanese Supreme Court with regard to Bruno Wang.