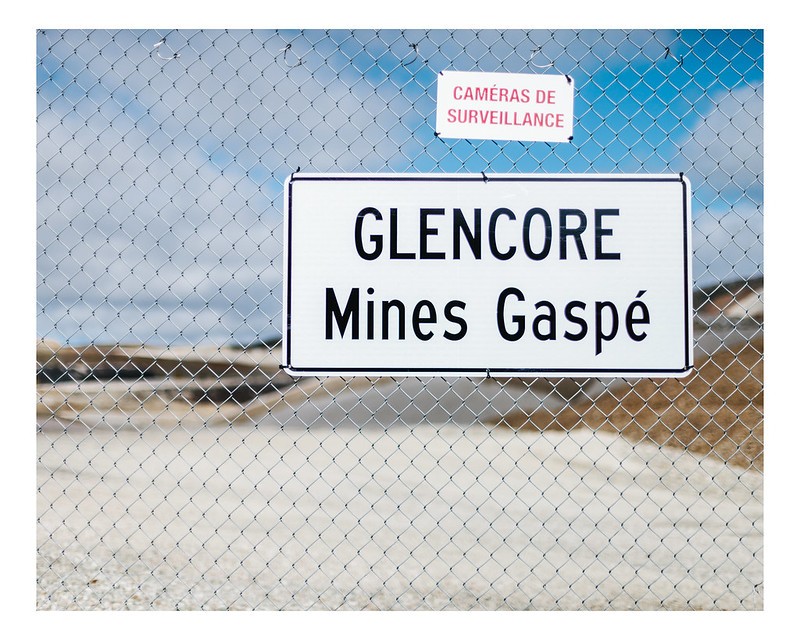

According to admissions and court documents filed in the Southern District of New York, Glencore engaged in a decade-long scheme to pay through intermediaries millions to officials in Nigeria, Cameroon, Ivory Coast, Equatorial Guinea, Brazil, Venezuela, and the Democratic Republic of the Congo (DRC).

The company said in a statement that it will pay more than $700 million to resolve U.S. bribery investigations and more than $485 million to resolve market manipulation investigations. Some of that will be used to settle similar charges in the U.K. and in Brazil.

“We acknowledge the misconduct identified in these investigations and have cooperated with the authorities,” said Glencore’s Chief Executive Officer, Gary Nagle.

The Swiss company “undermined public confidence by creating the false appearance of supply and demand to manipulate oil prices,” said Assistant Attorney General, Kenneth A. Polite, Jr. of the Justice Department’s Criminal Division.

The DOJ accused Glencore of bribing the officials through intermediary companies to secure oil and other contracts then camouflaging the bribes by entering into bogus consultancy contracts and by paying exaggerated invoices.

“The scope of this criminal bribery scheme is staggering,” said U.S. Attorney Damian Williams for the Southern District of New York, adding that the company also paid bribes to avoid government audits and that it paid judges to make lawsuits disappear.

The Serious Fraud Office (SFO), the U.K.’s top authority handling serious fraud, bribery, and corruption, has worked in parallel with the U.S. and together with Dutch and Swiss prosecutors on the Glencore probe.

The company pleaded guilty also at a hearing at the Westminster magistrates court in London on Tuesday.

“This significant investigation, which the Serious Fraud Office has brought to court in less than three years, is the result of our expertise, our tenacity and the strength of our partnership with the U.S. and other jurisdictions,” SFO Director, Lisa Osofsky, said.

At the same time, Glencore’s management promised that the company had changed.

“Glencore today is not the company it was when the unacceptable practices behind this misconduct occurred,” the company’s Chairman, Kalidas Madhavpeddi, said.

The management expressed its commitment to be a “responsible and ethical operator wherever we work,” and has presented significant steps to enhance ethics and compliance programs.