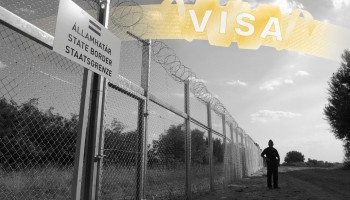

Hungarian Prime Minister Viktor Orban was characteristically blunt in a February speech to representatives of rural municipalities. He told them: “We do not want to be colorful.”

They knew what he meant. It’s a message he’s repeated for more than two years: Hungary is not interested in welcoming immigrants or refugees.

Orban has pushed this agenda on every front. He fought European Union (EU) rules that would have required Hungary to admit some 1,300 refugees seeking asylum. He organized expensive national consultations and advertising campaigns against immigration. Research by OCCRP partner Atlatszo shows that the Hungarian government spent €40.5 million on anti-immigration and anti-Soros propaganda last year.

But with all that, Orban and his government have no problem with immigrants of any color willing to pay big money to get into Hungary. In 2013, Hungary launched a Golden Visa program that urged foreigners from all over the world to come to Hungary and enjoy the full benefits of citizenship in the EU, including visa-free travel.

The Ministry of Interior has written that more than 24,000 foreign nationals, mostly from China, obtained permanent or temporary residency permits between 2013 and 2017. That is almost 20 times more people than the 1,300 asylum seekers Orban and his government so vehemently opposed on the grounds that they threatened Hungary’s very culture.

The difference? Golden Visa applicants had to buy a Hungarian residency bond, refundable after five years. The bonds were first sold for €250,000 and the price was later raised to €300,000. The program was suspended last year amid a public uproar.

It wasn’t anti-foreigner sentiment that powered the protests.

It was perceived corruption, based on the fact that Hungary required applicants to buy the residency bonds from eight intermediary companies which charged fat fees. (The eight were later reduced to five, after three had their licenses revoked.)

Most countries with similar programs just deal directly with the immigrants.

Seven of the eight companies were registered offshore to unknown owners. Civil society groups suspect the owners were politicians or people close to politicians.

The middle-man companies reaped huge profits: the €300,000 was what foreigners paid. But the companies paid only €266,000 for the bonds. This means they earned at least €34,000 on every single bond they sold—but on top of that they were allowed to charge fees of between €40,000 to €60,000.

According to an analysis by Atlatszo, the program generated about €320 million in fees for the companies, but who exactly got rich from the program remains unknown.

A Money-Loser for Hungary

The outstanding feature of Hungary’s Golden Visa program was that while the intermediary companies made huge profits, the country itself — meaning taxpayers — lost money.

When the bonds matured after five years, the government had to refund the principal and pay a guaranteed 2 percent rate of interest. In 2015, the interest rate on regular 5-year Hungarian state bonds issued in Euros fell below 2 percent. Hungary would have been better off financing the bonds itself on the open market.

Miklos Ligeti, the head of legal affairs at Transparency International Hungary (TIH), told Atlatszo that the Hungarian residency bond program was unique — and not in a good way.

“There are Golden Visa programs all over the world, and they are a bit sketchy everywhere,” he said. For example, a country might have heavy industry that has collapsed, or bonds or real estate it cannot sell, so it invites investors to put money into those in exchange for a residency permit. “Those states do not ask where the money is from, but they expect something in return,” says Ligeti.

But that is not what happened in Hungary.

Security Issues

Fidesz Party critics questioned the wisdom of the residency bond program, arguing that allowing more than 20,000 foreigners into the country posed a security risk.

Marta Demeter, a parliamentarian from the Lehet Mas a Politika (LMP) green party, said at a press conference in July 2016 that criminals were entering Hungary. She demanded that Golden Visas end until national security could be guaranteed.

The Ministry of Interior responded that all Golden Visa applicants were rigorously screened by the immigration office, the police, the anti-terror unit, and the intelligence service.

The newspaper Magyar Nemzet, however, located a Russian-born immigrant who had sailed through all those checks even though he’d been convicted of tax fraud. He obtained a Hungarian Golden Visa by providing a clean criminal background check from St. Kitts and Nevis, where he supposedly lived.

(St. Kitts and Nevis, a tiny Caribbean island nation, came up with the idea for Golden Visas more than 30 years ago.)

Politics permeated the Golden Visa program from the start.

Minister Antal Rogán proposed the idea in late 2012, and a bill listing the rules was drafted by a law office closely connected to Rogán, who heads the Orban cabinet. The program began operation in 2013. Rogán also heads the parliamentary committee that selected the intermediary companies that profited from bonds in the program. (see Golden Visas: From China to Hungary, in Hope and Fear)

Seven of the eight companies were assigned monopoly rights to sell in certain geographical areas. Ligeti of TIH notes that Arton Capital Hungary had a special place and role among the eight. it was the only one not owned by a secretive offshore entity; and the only one allowed to sell Hungarian bonds anywhere in the world rather than in just one area.

Foreign nationals who did not want to do business with the company responsible for their geographical area could travel to Hungary and buy the bonds from Arton.

“This provided a kind of a bonus to Arton,” says Ligeti. “This is a way for foreign nationals to buy the bonds in a way that is hidden from the eyes of the authorities in their home countries. A Chinese national could, for example, travel to Hungary as a member of a tourist group and buy the bonds in Budapest.”

This story was produced as part of the Global Anti-Corruption Consortium, a partnership between OCCRP and Transparency International.