On the evening of February 27, 2014, Daniel Atala Midence, the young scion of one of the most powerful families in Honduras, felt like a huge weight had been lifted from his shoulders.

He had just learned that the family company where he served as chief financial officer had secured a crucial tranche of funding for a hydroelectric dam it was building in the sprawling green highlands of western Honduras.

The project, called Agua Zarca, had been delayed by the protests of local indigenous groups, who said the dam would destroy a sacred river and decimate the fish stocks they relied on for food. After a protester was shot, the dam’s financial backer and co-developer had both pulled out.

So the Atala family and their company, Desarrollos Energéticos S.A de C.V. (DESA), were counting on financing from the region’s main development bank, the Central American Bank for Economic Integration (CABEI). When 27-year-old Daniel Atala learned that CABEI had finally signed off on a long-anticipated $24.4 million loan, he breathed a sigh of relief.

“I feel 50 lb’s lighter,” he wrote on WhatsApp to his girlfriend, in one of thousands of messages collated as part of a Honduran court case and obtained by reporters. Initially, he told her, he had been worried that CABEI wouldn’t sign the loan agreement, which also involved another $20 million from Dutch and Finnish lenders administered through CABEI.

“Damn, I was freaking out.”

But not only did the loan go through — it set in motion a project that would end in tragedy.

Two years after Daniel Atala’s late-night texts to his girlfriend, Honduran environmental activist Berta Cáceres, who was leading a campaign against the construction of the dam, was shot to death in her bedroom by a murder squad led by a former Honduran special forces sniper.

The assassins had been hired by the president of DESA, Roberto David Castillo Mejía, according to a Honduran court, which sentenced him last year to 22 years in prison for his role in ordering and planning her murder, alongside seven other men. (Castillo, who still has the right to appeal his conviction, did not reply to requests for comment. Honduran prosecutors have not accused Daniel Atala of any role in the murder.)

Thousands of words have been written about Cáceres’s murder and the subsequent fallout in Honduras. Yet little has been revealed about how CABEI agreed to help finance the Agua Zarca project in the first place.

Now, an investigation by OCCRP and Columbia Journalism Investigations reveals that the bank — which claims to prioritize projects that are environmentally sustainable and reduce poverty — ignored red flags when partnering with DESA and its powerful owners, the Atala family.

OCCRP obtained confidential internal audits stating that CABEI should have “examin[ed] the financial and technical capacity of the developer to make their investment” before approving the $24.4-million loan. The auditors noted that the company was valued at only $2 million even as it was taking on a $50-million project.

More worrying still, the people behind DESA — the Atala family and Castillo — had "no experience in power generation projects” when it was approved for the loan to build Agua Zarca, the audit noted.

In the text messages he sent to his girlfriend about the loan, Atala was frank about his own inexperience. “I feel bad now. I owe $44.4 million…. I’m [going to be] working for CABEI for the next 13 years to generate this much money…. I’m freaking out bruh.”

“Dannyyyyy!!!!” she responded. “All, absolutely all, companies go into debt.”

“Not that much, man,” he responded. “How come [my uncle and dad] aren’t freaking out, trusting so much money in two children?”

The audits show CABEI disregarded multiple warnings about the project’s risks, from concerns about environmental damage to reports that DESA was fueling tensions with the local community. They do not go into detail about why this happened, but the Atala family was well connected in Honduras — and at the bank itself.

Daniel’s father, Jose Eduardo Atala Zablah, a shareholder in the company that owned DESA, had served as the development bank’s Honduran director for two years in the early 2000s. His uncle, Jacobo Atala Zablah, is a prominent Honduran businessman who once headed Banco BAC, one of the largest lenders in the country. In 2021, OCCRP partner Contracorriente revealed that Jacobo Atala had helped set up several offshore companies for Porfirio Lobo, the president of Honduras from 2010 to 2014.

Neither Jose Eduardo Atala Zabala or Jacobo Atala Zablah replied to requests for comment.

In his text messages to his girlfriend, Daniel Atala said CABEI had taken a long time to sign off on the loan. “I had to use my Frank Underwood backchannels,” he said — a reference to the conniving main character in the Netflix series “House of Cards.”

“Jacko,” he added in the following message, using a nickname for his uncle Jacobo.

Atala claimed in a written response to questions from OCCRP that he had simply been boasting to sound more impressive.

“No back channels whatsoever were used to be able to approve this financing and if there was a text to a girlfriend saying something that was contrary to that it was only in the intention of courtship, trying to seem more interesting or in the pursuit of further conversation, as young men do when they are in a courtship,” he said.

He added that “extremely extensive” due diligence had been performed before his company was loaned the money for the dam, and emphasized that his father had left his directorship at CABEI years before.

“That does not seem like a conflict of interest, but I understand this information doesn’t fit the narrative you are trying to sell,” he said.

But Wout Albers, a human rights lawyer representing Cáceres’ family in a Dutch civil case against the FMO, another bank that lent to the project, said Jose Atala’s role in DESA should have set off alarms within CABEI.

The bank “must have realized that granting a $24 million loan to its former director created the impression of conflict of interest, or at least nepotism,” he said.

CABEI’s outgoing president, Dante Mossi, told OCCRP in an interview that he could not defend the bank’s decision to lend money for the Agua Zarca dam. He said it was one of many failing loans he inherited when he assumed his post in late 2018, calling the project a “disgrace.”

“I don’t know what got into the mindset of the board of directors who accepted this project,” he said.

The serious social risks of the dam project should have been obvious to anyone familiar with the Honduran context, Mossi said — particularly the complexity of land ownership in the traditional lands of the indigenous Lenca people.

“If I were president [at the time] this project would never have been accepted because I know this is communal land, you cannot buy a plot of land in that region.”

CABEI did not respond to multiple requests for comment.

‘New And Repeated Failures’

Berta Cáceres’ community, the indigenous Lenca people, had opposed Agua Zarca from the start, saying it would harm a sacred river, kill the fish they depended on for food, and destroy their livelihoods. The dam was among more than 40 hydroelectric projects that Honduras’ government had approved without consulting indigenous groups who would be affected.

In 2013, Lenca protesters set up a blockade at the site, but soon faced violent attacks, and harassment from security guards and troops. Work was suspended months later after one of the protesters, Tomás García, was shot dead by a Honduran soldier.

The conflicts surrounding the dam prompted DESA’s partner in the project, Chinese construction company Sinohydro Corporation Limited, to pull out. A key funder to the project, the CABEI-backed Central American Mezzanine Fund (CAMIF), also pulled out after a group of indigenous activists led by Cáceres lodged a formal protest with the complaint mechanism of the World Bank, which co-owned CAMIF.

Internal CABEI documents obtained by reporters say that CAMIF informed CABEI in February 2014 that it was withdrawing from the project because the new complaint had "raised the project risk to the maximum.” (Daniel Atala disputed this version of events, saying that his company had decided “not to pursue financing with CAMIF” due to a disagreement over the cost of the loan.)

CABEI had already approved the $24.4 million loan, but hadn’t yet formally signed off on it to be disbursed. CAMIF’s exit should have been a warning sign for the bank’s management, an audit of the project found.

Instead, bank officials and country managers in Honduras “did not carry out due diligence, and argued that CAMIF’s exit from the financing [was] due to [business reasons], without properly assessing that the exit actually responded to a complaint regarding the impact [of the dam] on neighboring communities,” the auditor found.

“This situation was not adequately investigated at CABEI.”

The report, written in 2018 — nearly two years after Cáceres’ murder — by the bank’s chief internal auditor, paints a damning picture of CABEI’s internal errors on the project, identifying “new and repeated failures in the systems of checks and balances” that should have prevented it from ever investing in the dam.

The audit notes that an external environmental assessor hired by CABEI had warned in February 2014 that DESA was fueling tensions with the local community, and that its reliance on military and police forces for security at the site had increased conflict.

The requirement for a copy of the report and the final Environmental and Social Action Plan to satisfy the investors and co-financiers, including CABEI, was considered met with the Environmental and Social Report conducted by the firm GAI on February 4, 2014…. The report highlighted the following:

i. DESA didn't fulfill all its previous social commitments, partly because the company lacked an established action plan.

ii. DESA didn't grasp the complexity of the land issues and ethnic problems in the affected area.

iii. DESA's reliance on security provided by military and police forces in the field escalated the tension and conflict level.

iv. This project is now classified as Category A according to the IFC Performance Standards, demanding regular independent monitoring, especially during the construction phase. (Previously classified as Category 'B').

Yet CABEI decided to proceed, signing off to disburse the loan to DESA later that month — sparking Daniel Atala’s series of relieved text messages to his girlfriend.

CABEI also missed multiple red flags about DESA itself. The audit of Agua Zarca said “no analysis was made of the financial capacity” of DESA before CABEI approved the loan. If the bank had, the document noted, it should have been concerned that a company with a book value of just $2 million was taking on such a big loan — especially when it was run by businessmen with no experience in power generation projects.

The bank justified the approval by noting that the project would have an external supervisor, but the auditor said that supervision should have been a basic requirement of such a project, “not an added bonus.”

“Once again, it is mistakenly assumed that the developer [DESA] is primarily interested in ensuring everything goes well,” the auditor wrote. “However, they are equally interested in concealing information if something goes wrong.”

The auditor also criticized the bank's culture of decision-making:

In our opinion, this way of acting is familiar in the Bank. Faced with the possibility of errors or omissions, the front office authorities prefer to amend without warning, interpret, or frankly omit conditions, out of apprehension or suspicion of receiving reprimands from the authorities that approved the operation (generally the Board of Directors), or in the worst-case scenario, that approved operations be nullified. In our opinion, this requires a review and discussion of the culture and manner of presenting and approving or disapproving operations.

Alberto Cortes, CABEI's Costa Rica director at the time of Cáceres’s murder, has been a longtime critic of the bank’s handling of the project. He was alarmed when he learned that an activist protesting a CABEI-funded project had been killed, and pushed for an internal investigation — which eventually led to the audit obtained by reporters.

He said he was able to discover through Google searches that the company’s president, Castillo, was a former military intelligence officer who had been fined in 2009 by Honduras’ Supreme Court of Auditors for selling overpriced computer equipment to the Honduran armed forces. In the same case, Castillo was also censured for drawing two state salaries as a military officer and an employee of the national electric company. (Neither Castillo, who is currently in prison, nor his lawyers responded to requests for comment.)

“I said, ‘If I was able to find this with a Google search, how is it possible that the committee that was in charge of due diligence, analysis, wasn't able to find this?” he recounted.

“[CABEI] didn't comply with the basic requirements and risk assessment that normally a solid bank should make,” he said.

The many issues raised by auditors, along with the ongoing opposition of the local community to the dam, "should have forced the developers of the project to implement new processes of consultation and socialization, which would have avoided tragedies like the death of Berta [Cáceres]."

Discount Debt Disposal

After news of Cáceres’ murder hit the headlines, condemnations of Agua Zarca started pouring in.

CABEI’s two co-investors, Dutch development bank FMO and Finnish financier Finnfund, formally pulled out of Agua Zarca in July 2017, leaving CABEI as the project’s only international lender. While the bank had stopped giving out more money to the project, it had already disbursed $9.4 million.

Not only was this debt in default since DESA had stopped repaying its loan shortly after the murder, but it had become a political hand grenade. The dam project had also racked up dozens of complaints from local communities. By the time construction on the dam was suspended in July 2016, CABEI had received 71 such complaints, 43 of which were unresolved, according to an internal evaluation seen by reporters.

Mossi, who took over the bank’s presidency in late 2018, called the Agua Zarca debt a “toxic asset,” but said the bank was not in a position to simply forgive the loan.

“The project went bad [but] we had an obligation there, so I said, ‘Let’s sell it to the best party.’”

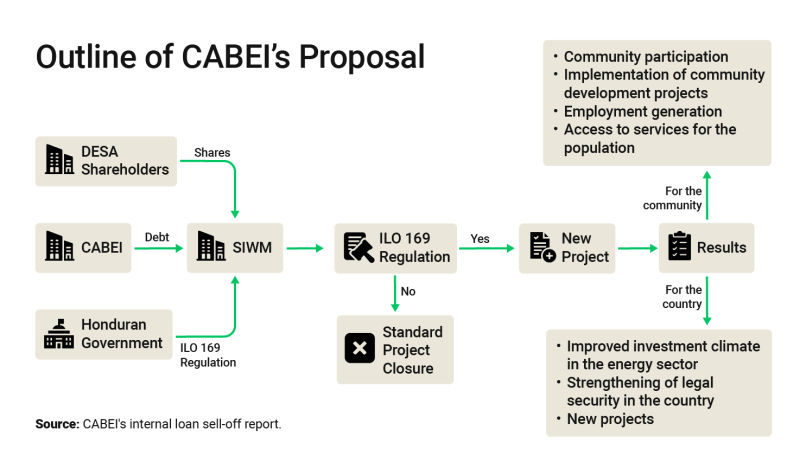

In March 2019, the bank agreed to sell the debt to a firm called Swiss International Wealth Management (SIWM) for $500,000. According to an internal CABEI memo on the agreement, the Swiss company planned to strike a separate deal with DESA to acquire its shares, giving it control over the entire dam project. (Daniel Atala declined to comment on whether this had happened, citing a non-disclosure agreement he had signed.)

SIWM had made the bid almost a year earlier, in the spring of 2018, before Mossi was made president of the development bank. Guillermo Bueso, the chief executive of Honduras’s largest bank, Banco Atlántida — a good friend of Mossi from their university days — had written to CABEI to “make an initial introduction” between the development bank and SIWM.

The bank initially declined to go ahead with the sale because it said it didn’t have enough information about SIWM. At some point over the ensuing months, however, it reopened talks with the company. It is unclear whether this happened before or after Mossi took over the presidency of the bank in late 2018.

Shortly after SIWM purchased the debt, its U.K. parent company, Portofino Holdings, went through a series of ownership changes until it ended up in the hands of Bueso — the friend of Mossi who had introduced the Swiss firm to CABEI.

A Questionable Debt Deal

Bueso did not respond to requests for comment. Swiss International Wealth Management, which has since changed its name, also did not respond.

Kush Amin, a legal specialist at Transparency International, reviewed the chain of transactions that led to Agua Zarca appearing to end up in Bueso’s hands and said it demonstrated “a clear failing in the internal process for the sale of these assets.”

“Is there any evidence that the bank conducted due diligence into the reliability and past experience of Swiss International Wealth Management that allowed them to sell the (incredibly politically sensitive) loan at a huge discount?” he asked. “Were there any other offers?”

Mossi told OCCRP that he was a “good friend” of Bueso, whom he knew from when they both attended Vanderbilt University, where they met over free wine and cheese at a student event. He said when he joined the bank and saw the proposal from SIWM, he recognized immediately that the firm was connected to Bueso, despite not having his name on it.

“I know the close group that works with Guillermo Bueso,” he said.

However, he said that his relationship with the banker had not influenced the sale of the debt.

“When I saw the name of someone I knew, I recused myself” from the board meeting to discuss the Swiss proposal, he said, adding: “And yet, financially, it was a very good decision.”

Amin said Mossi’s prior relationship with Bueso — and the fact that the deal went through after Mossi took over as executive president of the bank — would justify an investigation by the bank.

“The fact that the debt appears to have ended up being owned by Bueso personally (through companies headed up by other Banco Atlantida directors) would justify an investigation by CABEI given his friendship with Mossi.”

Adding Insult to Injury

According to a proposal for the sale of the debt to Swiss International Wealth Management, CABEI hoped that the transaction could help “reactivate the [Honduran] energy sector.”

What the bank meant by this was that the $500,000 it earned from selling the loan would be donated to the Honduran government for what it referred to as a “socialization campaign.” The campaign aimed to get buy-in from indigenous communities on a new draft law on how these groups should be consulted about new development projects.

Mossi told OCCRP he had been in favor of this plan.

“Look, what I said to the board is, ‘Look we can keep this toxic asset in our books or we can get rid of it and with the proceeds of what we have, we can basically help the government do it right."

This, CABEI officials wrote in an internal report about the sale of the loan, could help streamline government procedures for future energy projects — and open up the possibility of one day restarting the stalled Agua Zarca project.

"The support that the Central American Bank for Economic Integration (BCIE) will provide to the Republic of Honduras will not only facilitate the development of the Agua Zarca Hydroelectric Project, but will also open up the opportunity to pursue new investment projects that have been stalled due to gaps in regulation,” the report said.

A freedom-of-information request filed by OCCRP’s Honduran partner, Contracorriente, confirmed that the $500,000 donation was made, and that it was to be “used exclusively to support the socialization strategy for the approval” of the new draft law, known as OIT 169.

Amin, the Transparency International specialist, said the use of the $500,000 for the “socialization campaign” also cast the initial sale of the loan in a new light.

“They may have hidden their sale of the loan to Mossi’s friend … and simultaneously advocated for the same loan to be worth a lot more if the change in law was successful.”

OIT 169 was widely unpopular among Honduras’s indigenous communities, said Karen Spring, the coordinator of the Honduras Solidarity Network, which brings together around 30 organizations from the U.S. and Canada that support civil society in Honduras.

“They basically rejected it,” she said. “[They said], ‘This is not sufficient. It will not protect our rights. We don’t support it.’”

Details of CABEI’s financial support of the draft law have never before been made public. Berta Cáceres’s daughter, Bertha Zúñiga Cáceres, called the news “truly disheartening.”

OIT 169, she said, was an attempt “to legalize the violation of indigenous communities' rights by enacting laws to facilitate the entry of more projects and provide more flexibility for economic ventures, including energy generation projects and land dispossession.”

Jonny Wrate (OCCRP), Angus Peacock (OCCRP), and Fernando Silva (Contracorriente) contributed reporting.

Mariana Castro is a reporting fellow for Columbia Journalism Investigations, an investigative reporting unit at the Columbia Journalism School.