The Kazan gunpowder plant in southwest Russia, whose entrance is framed by two cannons, has been producing munitions for the Russian army for over two centuries.

Like others around the country, the factory has stepped up production since 2022 to feed Russia’s war machine, which relies heavily on artillery fire in the conflict in Ukraine.

While Western sanctions have complicated Russia’s efforts to secure a range of foreign-made military technologies, Moscow can still count on two Central Asian countries to supply the Kazan plant and other state factories with a key component of gunpowder: cotton pulp.

When mixed with certain acids, the fibrous product, also known as cotton cellulose, can be transformed into a highly flammable propellant used in explosives.

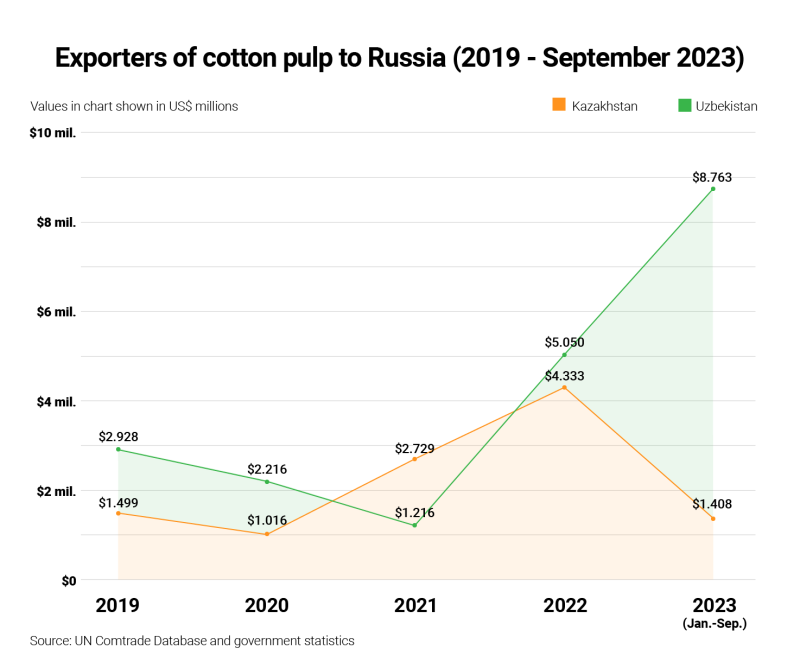

Documents obtained by OCCRP and its partners Vlast and IStories show that Kazakhstan and Uzbekistan have supplied over 98 percent of Russia’s imported cotton pulp for the past decade — and that the trade has grown since Russia’s full-scale invasion of Ukraine.

According to leaked export-import operation data, in the first nine months of 2023, Uzbek firms exported some $8.7 million worth of cotton pulp to Russia — more than 70 percent than they did the entire previous year.

Kazakhstan, whose cotton pulp exports go to almost exclusively Russia, also ramped up its shipments in 2022, sending nearly 60 percent more than the previous year, according to the United Nations Comtrade database. Government statistics show a sharp decrease in exports in the first ten months of 2023, but the data could not be independently confirmed.

Most of the private firms responsible for these exports did not respond to requests to comment, though two said their products were used by Russian plants for lacquers and paints, not gunpowder.

While reporters could not confirm the final use of the cotton products in Russia or link it directly to the battlefield in Ukraine, public procurement contracts show cotton cellulose imports from both countries have been bought by Russian munitions factories for defense purposes.

Those state plants, which specialize in the manufacture of gunpowder, ammunition, and artillery, do not release official data about their output and did not respond to requests for comment. Four of the plants have been sanctioned by the U.S., Switzerland, and Ukraine.

Like other traditional Kremlin allies, Kazakhstan and Uzbekistan have attempted to pull off a delicate diplomatic dance since Vladimir Putin launched his full-scale invasion of Ukraine in February 2022.

Both countries have taken a neutral stance on the war while continuing to maintain long-standing diplomatic and economic ties with Moscow. But the Central Asian states have also welcomed engagement from Washington and Brussels, who they have promised to help curb sanctions evasion — the practice of re-routing Western goods through third countries before re-exporting them to Russia.

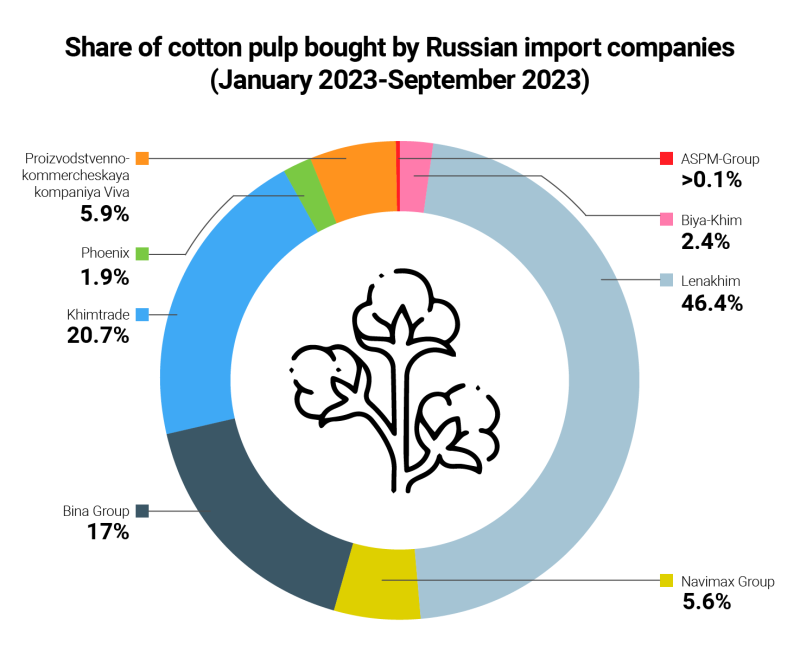

Most of Uzbekistan and Kazakhstan’s cotton pulp exports to Russia were sold first to private import companies, which then sold the product to the sanctioned state powder factories. But at least two Uzbek exporters have made direct deals with Russia’s military factories, trade data shows.

Those direct sales could raise the risk of secondary sanctions, according to Eric Woods, a specialist in export controls at the James Martin Center for Nonproliferation Studies at the Middlebury Institute of International Studies at Monterey. Russia’s cotton pulp importers could also be targeted, he told OCCRP.

“Ukraine’s partner countries are increasingly aggressive in going after non-sanctioned intermediaries,” he said. “If specific intermediaries are supplying to sanctioned entities involved in military production that will be investigated as a violation with secondary sanctions imposed.”

While cotton pulp can also be used for other goods, it has been subject to export controls in the European Union since June 2023 because of its potential military uses.

When reached for comment, Kazakhstan’s Ministry of Foreign Affairs, which has stressed its commitment to avoiding potential sanctions, said that cotton cellulose shipments to Russian gunpowder plants were not within its “competence” and recommended contacting other ministries.

One of those ministries, the Ministry of Trade and Integration, recommended contacting the Ministry of Industry and Construction, which is in charge of identifying which goods require special export licensing. According to a government database, cotton cellulose is not subject to export control in Kazakhstan.

Uzbekistan’s Ministry of Foreign Affairs did not respond to requests for comment.

White Gold of Uzbekistan

Uzbekistan has long been known for its snow-white cotton — the country was responsible for supplying much of the Soviet Union, and notoriously relied on forced labor in its fields.

While that practice has been largely rooted out, Uzbekistan remains a major cotton grower, and was ranked fourth among the world’s exporters of cotton cellulose in 2022, according to the UN Comtrade database.

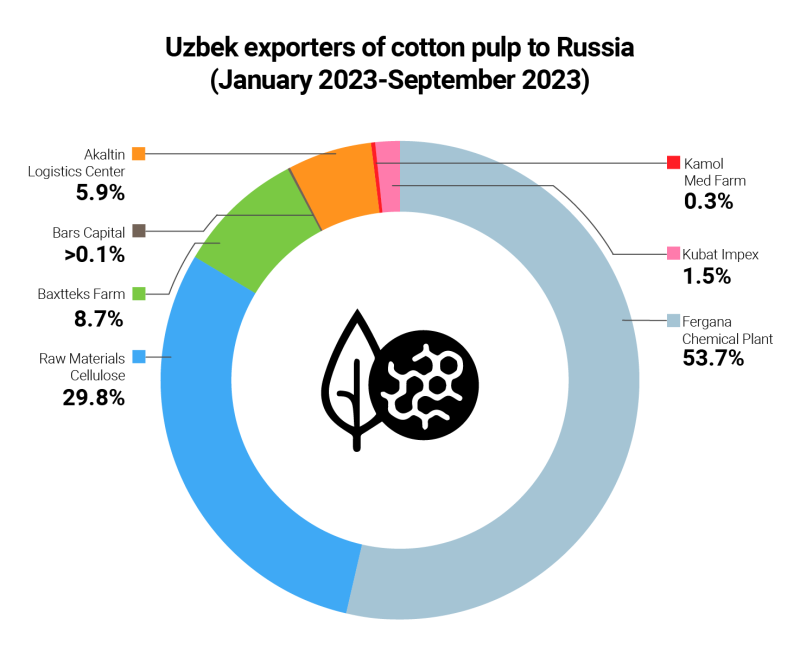

Data obtained by reporters shows that at least seven Uzbek companies sold a total of 4.8 million kilograms of cotton pulp to Russian import companies in the first nine months of 2023.

Documents from Russia’s Federal Taxation Service obtained by reporters also confirm that at least three Russian importing companies — Bina Group, KhimTrade, and Lenakhim — sold imported cotton cellulose to Russia’s military plants this year.

Uzbekistan’s top supplier was Fergana Chemical Plant, one of the country’s largest cotton pulp producers, according to its website. Corporate records show the company’s ultimate owners are two Russian citizens.

In addition to selling to Russian importers, the Fergana factory also made direct shipments throughout 2022 and early 2023 to two Russian gunpowder plants — in Kazan and Perm — for over $2.2 million, according to the trade database Import Genius.

The other top Uzbek exporter, Raw Materials Cellulose, is a little known company which partners with Russian and other foreign manufacturers of “sodium carboxymethylcellulose, nitrocellulose and gunpowder,” according to its description on an online business platform. Nitrocellulose is the flammable byproduct of cotton pulp used to make propellants.

While most of the company’s exports were sold to Russian importers, in 2022 Raw Materials Cellulose also made 14 direct shipments to Russia’s Tambov powder plant for almost half a million dollars, trade data shows.

In 2023, the company’s exports to Russia totalled at least $2.6 million, which appears to be a major increase from the year prior according to the available data.

The Russian import company Lenakhim confirmed it supplied cotton pulp from the Fergana Chemical Plant and Raw Materials Cellulose to "enterprises with which we have contractual obligations for the supply of cotton pulp," but said it did not know what the enterprises did with the product. Other importers did not respond to requests for comment.

Since the invasion, Russia’s state powder plants have largely stopped releasing public records about their procurement of cotton pulp, making it difficult to track the ultimate destination of the shipments. Under Russian law, public disclosure requirements do not apply to information that could constitute a state secret.

Yet some long-term contracts signed before the conflict erupted, or shortly thereafter, show Uzbek cotton cellulose was bought specifically for defense purposes.

A public procurement document signed in late 2021, for instance, shows that cotton pulp produced in Fergana was secured by Russia’s powder plant in Perm until the end of 2022 for the production of ballistite, an explosive that can be used for smokeless powder or rocket fuel. The procurement was conducted for “providing defense of the country and safety of the state,” according to the contract.

When reached for comment, Fergana Chemical Plant said its cotton cellulose does not meet the requirements for the production of “special powders.”

“For the most part, it is used as nitrocellulose, which is intended for the production of nitro varnishes,” read a letter from the company. The letter also denied having any direct contracts with the Russian powder plants.

“Cooperation with Russian companies is strictly controlled both by us and by the government and banks of Uzbekistan in order to avoid our products and company being included in the sanctions lists,” the company said.

The General Director of Uzbekistan’s other top exporter, Raw Materials Cellulose, did not answer reporters' questions. Other exporters from Uzbekistan did not respond to requests for comment by the time of publication.

All to Russia

The other half of Russia’s cotton pulp imports — 46 percent in 2022, the year of the invasion — came from neighboring Kazakhstan.

The country’s cellulose production has been concentrated in the hands of one firm, Khlopkoprom-Cellulosa. That cotton cellulose from this company’s factory has previously been used by Russia to produce gunpowder is no secret — media reports from before the war confirmed this to be the case.

Several contracts seen by reporters show that Kazakh cotton pulp has continued to go to Russia’s gunpowder plants since the invasion.

One long-term contract signed in March 2020 secured Kazakh cotton pulp for the Kazan powder plant until January 2026. Another, signed in December 2022, ensured shipments for the Aleksin Chemical Plant, which also produces gunpowder, until January 2024.

In a phone call with reporters, Ravshan Nurbekov, a representative of Khlopkoprom-Cellulosa, confirmed the company sold pulp to Russian importing companies, but said it was ultimately used for paints and lacquers — not gunpowder.

While Russia’s gunpowder factories also produce those paint products, several contracts seen by reporters show they procured Kazakh pulp for defense purposes.

A contract from the Aleksin chemical plant that was signed just three days before Russia’s invasion of Ukraine said a 213.9 ton supply of Kazakh cotton cellulose running until the end of 2023 was part of a state defense procurement.

A separate contract ordering 300 tons of Kazakh cotton pulp to the plant until May 2023 said that the cellulose may be used for state defense purposes as well.

Khlopkoprom-Cellulosa’s representative Nurbekov told reporters the company stopped all production this summer after partners of the importing company they sold to were sanctioned.

“Due to the fact that we can not supply [them], our factory stopped working,” Nurbekov said, adding that the company is looking for importers in Europe and is not planning to resume shipments to Russia.

In October 2023, Kazakh government data shows another shipment of 19 tons of cotton pulp was sent to Russia, though the exporter is not specified.

Russia’s heavy reliance on artillery makes its gunpowder needs especially critical. At the start of the invasion, its forces used an estimated 80,000 shells per day, according to Alexander Kovalenko, a military analyst from the non-governmental Ukrainian platform “Information Resistance.”

As the war has dragged on for longer than expected, those figures have declined to around 15,000 per day, he said.

“All of this shows how serious their deficit is now, how depleted ammunition warehouses are, and how dependent Russia is becoming on any supplies of any ammunition of any caliber … and the necessary elements, including the chemical elements, for their production,” Kovalenko said.

While Russia only grows very small quantities of its own cotton, there have been studies and discussion of the possibility of extracting cellulose from domestically grown crops, such as wood or flax. It’s unclear how long the switch in production would take, or what the costs would be.