It was early 2019 and executives at Swedbank were worried. News that their bank’s Estonia business may have been used to launder billions of dollars had broken a few days earlier, and they were scrambling to contain the fallout.

On February 25, a memo was circulated to staff outlining measures that the bank had taken to deal with “high-risk” clients in previous years, including hundreds of customers whose accounts had been closed. Among them was Solway Investment Group, a metals company that operates mines and smelting facilities around the world.

Most of the companies in the Solway group were identified as “holding/transaction entities,” some of which had carried out “questionable transactions,” said the memo, obtained by Eesti Ekspress. It noted Solway had “declined the request to present correct ownership documentation” and so was “offboarded in 2011.”

Swedbank dropped Solway at a time when huge sums of suspect money were flowing through its Baltic operations. Investigators would later find that at least 200 billion euros were laundered through accounts in the Estonian branches of Swedbank and Denmark’s Danske Bank between 2007 and 2015. Much of this flowed from Russia and Eastern Europe to shell companies, in one of the world’s largest-ever money laundering scandals.

Now, a data from these banks leaked to Swedish broadcaster SVT — analyzed as part of the Mining Secrets project led by Forbidden Stories — has identified hundreds of questionable payments that might have led Swedbank to drop Solway as a customer.

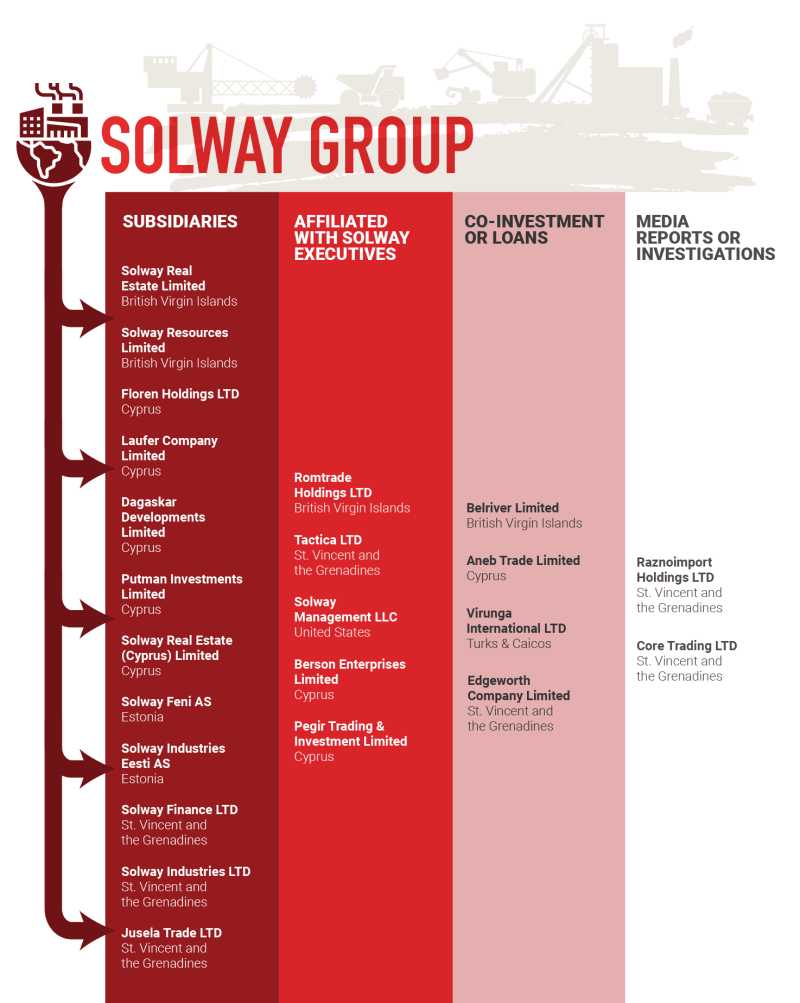

Reporters identified 23 companies related to the mining group that moved close to $1.9 billion between 2007 and 2015 in large, round-dollar payments without a clear business purpose — hallmarks of what is known as “suspicious activity.” OCCRP established that all of them have been linked to the Solway group or its senior executives.

Maíra Martini, who leads Transparency International's anti-money laundering work, said anonymous companies are commonly used to move questionable money because it is so difficult to determine who owns them.

“It is not uncommon to use a network of companies, including shell companies and others with real operations, to engineer transactions that mix legitimate and illegitimate funds,” she said.

Swedbank wasn’t alone in its concerns about these companies. Other banks also flagged some of them to the U.S. Treasury’s financial crimes bureau for making suspicious transactions during the same period, according to reports leaked to BuzzFeed News as part of a project coordinated by the International Consortium of Investigative Journalists, known as the FinCEN files.

It’s unclear where any of the $1.9 billion originated, or why Solway would need to move money around like this. But buried in banking records from previous OCCRP investigations, reporters found that companies from the group of 23 had transacted with other companies used in Russian tax evasion and money laundering scandals.

A former Swedbank official, who spoke on condition of anonymity, said the country of Estonia positioned itself as a “kind of transit republic” for Russian money at that time.

“Today, having connections to the Kremlin is a negative,” the former official said. “At that time, it was more of a reassurance that your client would probably have a slightly longer career than other clients.”

Solway denied it had been involved in any illicit transactions, saying it acts “strictly in line with applicable national laws and international regulations” and works to combat corruption. A spokesperson declined to comment on Swedbank’s decision, except to say Solway had “followed all the necessary procedures to comply” with the bank’s new policies.

“Solway Investment Group firmly rejects the allegations of money laundering and corruption. No accusations of wrongdoing were ever brought against us by any financial or regulatory bodies,” the company said.

After OCCRP and 20 partners published an array of stories this week as part of the Mining Secrets project, Solway released a statement rejecting reporters’ findings and adding that the company has exited all of its investments in Russia.

Swedbank declined to comment on individual customers, but noted that it had already been fined by authorities for “past shortcomings in the management and control of measures against money laundering in the bank's Baltic operations.”

Danske Bank also declined to discuss its Estonian business, which is still being investigated, but said it had invested significantly in compliance systems. “We are now in a different position with respect to combating financial crime and money laundering than when the situation in Estonia developed,” said chief administrative officer Philippe Vollot.

Red Flags

OCCRP scoured corporate registries and leaked documents to identify who controlled the 23 companies involved in the suspicious transactions. In a few cases, details of their owners and directors were publicly available.

Other companies were based in secrecy jurisdictions, so reporters relied on listings of subsidiaries or “related entities” in old Solway annual reports. Filings to the U.S. regulator, found in the FinCEN files, gave clues that two more were linked to Solway.

By piecing together this disparate information, reporters found 21 companies had corporate ties to Solway or its senior executives at some point during the period of the suspicious transactions.

In several cases these executives — which included Solway’s co-founders Aleksandr Bronstein as his son Dan, along with Solway group secretary Andre Seidelsohn — directly represented or controlled the companies. One was owned by companies belonging to another group director, Christodoulos Vassiliades, a Cypriot lawyer who has reportedly worked with notorious Russian crime boss Semion Mogilevich.

It’s not clear who owned the other two companies, Core Trading Ltd and Raznoimport Holdings Ltd, but media reports and official investigations show that they have ties to the mining group and its founders stretching back years.

Solway disputed the connections, saying that only 13 companies out of the 23 identified by reporters are related to the mining group. Vassiliades did not respond to a request for comment, but his law firm has previously said that it complies with due diligence regulations.

SVT used the same techniques as financial investigators to identify suspect transfers made by these companies, looking for frequent transfers of large, round-dollar amounts made for no clear reason. In total, reporters flagged more than 1,000 transactions, together worth close to $1.9 billion, made between 2007 and 2015. Anti-money laundering experts who reviewed some of the data confirmed the transfers ought to raise red flags.

Most of the transactions were described as payments for loans. The records show some of the companies moved money back and forth between them, or made several payments in the same week or day citing the same or similarly named agreements.

“Why is a company apparently both borrowing and lending similar amounts? This doesn’t make commercial sense,” said Graham Barrow, an expert in financial crime who reviewed some of the transaction data.

“When a company has a complex corporate structure and moves money around within that structure for no obvious commercial benefit, it will likely be viewed by the bank as a ‘red flag.’”

One of the most prolific companies was Tactica Limited, which a leaked 2011 report from the FinCEN files suggested was affiliated with Aleksandr Bronstein. Tactica made over 750 transactions worth more than $900 million between 2007 and 2011, most of them with another company from the group of 23 named Core Trading. Almost all the transactions, including multiple payments on the same or consecutive days, were described as related to the same loan agreement.

Solway declined to comment on the transactions, but said that “in general, all transfers and deposits were held as a normal course of business and are common entrepreneurial practices.” A spokesperson denied that Solway was affiliated with Core Trading or Tactica, but did not address whether Bronstein had any relationship with Tactica.

“Swedbank and Danske Bank have been subjected to thorough and long-term criminal and civil investigations. Solway group has never received any questions from either the banks [or a] prosecutors’ office during those legal actions,” added a spokesperson.

Natalja Kesler, who has been a representative of Tactica, declined to comment on the company’s transactions, but said “everything with it is in order.” She said she had worked with Aleksandr Bronstein for 33 years and he was only ever involved in lawful dealings.

“Mr. Bronstein’s principle is that everything should be transparent,” she said.

OCCRP could not confirm who owned Core Trading, which was at one point registered in St. Vincent and the Grenadines at the same address as Tactica. Reporters did, however, find leaked documents linking the company to alleged tax evasion by two of Solway’s subsidiaries.

One of them, the Pobuzhsky Ferronickel Plant in Ukraine, was accused of using fake contracts with Core Trading and several local companies to evade around $1 million of taxes between 2011 and 2014. The case was thrown out after the company convinced a court the transactions were valid.

North Macedonia’s Ministry of the Interior also accused another Solway company, which operates a copper and gold mine there, of working with Core Trading to manipulate prices of copper concentrate to evade taxes between 2006-2008. Investigators put together a report outlining the allegations and prosecutors opened a case, but it has since stalled, as often happens in the country.

Solway did not address questions about the mining company’s relationship with Core Trading, except to say it is not part of the group. A spokesperson added that there had been “a number of audits and investigations related to the operational activity of Pobuzhsky Ferronickel Plant,” none of which “resulted in any further legal actions.”

Reporters were unable to reach Core Trading for comment.

Filings with FinCEN

It wasn’t just investigators in Eastern Europe who were suspicious. International banks also flagged four of the 23 companies to the U.S. Treasury Department’s Financial Crimes Enforcement Network, or FinCEN.

These reports, all made between 2011 and 2016, are not proof of wrongdoing. But they show that bank compliance officers identified similar issues as reporters.

Solway’s SARs

Asked about the suspicious activity reports, a Solway spokesperson said the group had no relationship with Deutsche Bank, adding that Aleksandr Bronstein “is currently retired and is not involved in Solway's operational activities.”

Russian Scandals

At the same time as the 23 companies were transferring funds to each other, several were also transacting with companies that have been used to move money in major Russian money laundering scandals.

Most of the payments were found in leaked records from Troika Dialog, which was once Russia’s largest private investment bank. In 2019, OCCRP and its partners revealed that it sat at the center of a vast financial “laundromat” that churned billions of dollars through offshore companies on behalf of its clients, including powerful oligarchs with ties to the Kremlin.

One criminal inquiry tied to the Troika Laundromat focused on a tax scam allegedly run by Sergei Tikhomirov, who was accused of using fake contracts to hide the profits of Russian insurance companies offshore. According to arbitration documents, these companies, including state giant Rosgosstrakh, used his network to evade at least 700 million rubles (around $23 million at the time) of tax.

Tikhomirov allegedly used hundreds of shell companies to move an estimated 50 billion rubles out of the country between 2006 and 2009. Russian prosecutors say one of these companies was South American Reinsurance Company (SARC), which is registered at an address near Montevideo’s Presidential Palace in Uruguay.

Buried in leaked data from the now-collapsed Troika bank, reporters discovered SARC also transferred more than $1.4 million to two of the 23 companies at the time of Tikhomirov’s scam. Most of the dozens of payments were made to one of the mining group’s subsidiaries, Solway Real Estate Limited. All were listed as payments for consulting or securities.

Barrow, the anti-money laundering expert, said consultancy agreements are often a “useful way of moving dirty money around the world as it is very difficult to trace ‘consultancy’ in any meaningful sense.”

“This certainly has the hallmarks of ‘suspicious,’” he said.

Tikhomirov fled Russia after a warrant was issued for his arrest in relation to the scheme, but he reportedly returned to the country in 2015. Reporters were unable to reach him for comment.

A Solway spokesperson said the company had no record of payments made to SARC or any of the other companies that have been linked to the Russian scandals in the company’s archive, which covers the past 10 years.

SARC and two other offshore companies that carried out transactions with entities in the Solway cluster were also suspected of being part of a $967-million money laundering scheme run by a Russian organized crime group.

In 2019, asset manager Hermitage Capital lodged a complaint with Austrian authorities alleging SARC and the two other offshores — Weenlix Trading Inc. and Merabella Ltd. — had helped channel nearly $40 million of suspect funds into Austrian banks. Hermitage suspected some of that may have been stolen from Russian state railways.

Other funds channeled through Weenlix were thought to have come from a major Russian tax scam known as the Magnitsky case. The fraud was exposed by a tax lawyer working for Hermitage, Sergei Magnitsky, whose jailing and subsequent death from maltreatment prompted the passage of sweeping new anti-corruption laws in the United States and elsewhere.

OCCRP data shows that Merabella and Weenlix paid close to $1.5 million to Solway Real Estate and another company from the 23 between 2006 and 2009, mainly marked as payments for office equipment. Over the years, SARC, Merabella, and Weenlix transferred close to $2.9 million to companies in the group of 23.

“Transactions labeled generally for things like consulting or legal services and office equipment are an easy way to make illegitimate transfers of value between companies look genuine,” said anti-money laundering expert Eryn Schornick.

“Airs of legitimacy can quickly dissipate and a trend toward the involvement in illicit business as a pattern of doing business with nefarious companies and individuals emerges, especially in an operating environment that we would later learn was rife with money laundering.”

A spokesperson said Solway has no Russian funding and is “fully owned and managed by EU citizens,” adding that the mining company exited all its investments and operations in Russia this month.

“In the past, Solway operated several mining and metals projects in Russia, but recently it had very limited investment and operating activity on that market,” Solway said.

Stelios Orphanides (OCCRP) and Graham Stack (OCCRP) contributed reporting.