According to the department’s Office of Foreign Assets Control (OFAC) enforcement release, Deutsche Bank would pay two settlements of $157,500 and $425,600 for each infraction, which some have argued is a negligible amount for a financial institution that has an annual revenue in the tens of billions.

The first settlement, according to the release, was accepted for the $28,849,038.39 in funds that the bank processed through the United States in August of 2015 on behalf of a Cypriot oil company that had recently been designated as an entity that was linked to an individual who was “contributing to the situation in Ukraine.”

The release explained that at the time Deutsche Bank processed the transaction for the oil company, it “had reason to know” of this designation, given that it “closely coincided” with the date in which it was listed.

The second and larger settlement was due to its processing of 61 payments in December of 2014 to Krayinvestbank, a Russian financial institution that had been designated for its role in the annexation of the Crimea region of Ukraine.

As part of the settlement, Deutsche Bank “agreed to maintain robust compliance procedures by ensuring that its management team is committed to compliance,” the release said.

It also explained that one of the mitigating factors for calculating the total settlement was that the bank “does not appear to have acted with willful intent to violate U.S. sanctions law or with a reckless disregard for its U.S. sanctions obligations” and that no senior staff appeared to be aware of the conduct that led to the recorded violations.

Some, however, have criticized that the amount was not sufficient for a financial institution that has repeatedly enabled money laundering and other fraudulent financial activity.

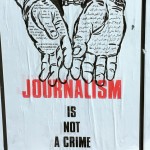

David Enrich, a journalist and author of “Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction”– a book that alleges many instances of the bank’s financial recklessness and criminality – weighed in on Twitter, saying that the bank once again “completely dropped the ball on scrutinizing high-risk transactions for certain clients.”

He went on to argue that one would be correct to think that “a six-figure settlement is not much for a bank of Deutsche Bank’s size,” and that it is “impossible not to mention” that the president of the United States is a major client of the bank, which is “by far his biggest creditor.”

On the same day that the settlement was announced, Bloomberg reported that the bank had retained Robert Kimmitt, a long time friend of U.S. Attorney General William Barr, to advise its supervisory board.

Some senior industry executives, according to the outlet, believe that the hire may help soothe the numerous pending Justice Department investigations against the firm.

Editor’s note: Initially OCCRP erroneously reported that Deutsche Bank retained Robert Kimmitt to sit on its supervisory board. The story has been corrected to show that Deutsche Bank retained Robert Kimmitt to advise the supervisory board.