Among the suspects are Richard John Gnodde, the chief executive of Goldman Sachs International, and John Michael Evans, who in 2013 left the bank and later became president of Alibaba Group.

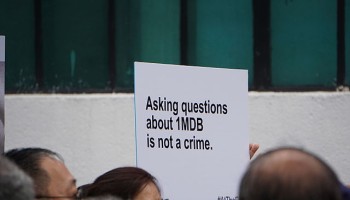

Last summer, US prosecutors were pressing a former Goldman Sachs executive for information about the bank’s complicity in the siphoning of billions from the investment fund that was embroiled in controversy over allegations that it was looted of more than $4.5 billion under the watch of former Prime Minister Najib Razak.

In 2012 and 2013, Goldman raised US$6.5 billion through bond sales for 1MDB. Investigators say $2.5 billion was embezzled by Malaysian senior officials. As part of the deals, Goldman pocketed an unusually large $600 million in fees for its work selling the bonds.

“Custodial sentences and criminal fines will be sought against the accused... given the severity of the scheme to defraud and fraudulent misappropriation of billions in bond proceeds,” Malaysian attorney general Tommy Thomas said in a statement.

He clarified that the charges were brought under a section of the Malaysian Capital Markets and Services Act that holds certain senior executives responsible for offences that may have been committed by the firm, with each charge carrying a maximum of 10 years behind bars and a penalty of not less than $238,000.

In December last year Malaysian authorities had filed criminal charges against three Goldman Sachs subsidiaries and two of its ex-employees, also in connection with 1MDB. The government demanded up to $7.5 billion in reparations from Goldman Sachs for its dealings with the Malaysian sovereign wealth fund.

The firm has been denying wrongdoings, stressing that some “members of the former Malaysian government and 1MDB lied to Goldman Sachs, outside counsel and others about the use of transaction proceeds.”

Goldman Sachs, reportedly, said on Friday that “1MDB provided written assurances to the bank for each transaction that no intermediaries were involved.”

“We believe the charges announced, along with those against three Goldman Sachs entities announced in December last year, are misdirected and will be vigorously defended,” media quoted the Goldman Sachs spokesman’s reaction to the announced charges.

The US Department of Justice has also been working on the case, investigating the Goldman Sachs’ role as “underwriter and arranger of the bond offer.”

According to the Justice Department, an estimated $4.5 billion was misappropriated from 1MDB by fund officials and their associates between 2009 and 2014.

The 1MDB saga, according to the Business Insider starts as early as in 2009, when Najib Razak, Malaysian Prime Minister at the time, established the fund, which started “buying privately owned power plants and planned a financial district in Malaysia’s capital Kuala Lumpur.”

Although it was originally set up to finance infrastructure and other economy-linked deals in Malaysia, 1MDB, reportedly, “veered into lavish spending, producing films such as “The Wolf of Wall Street” and buying casinos, champagne and “Dustheads,” -- a painting by US artist Jean-Michel Basquiat.”

The scandal, according to the paper, goes even deeper -- to the US President.

The Justice Department, according to the Wall Street Journal, is allegedly probing “a $100,000 donation to President Trump’s Victory PAC (political action committee) in 2017, which “may have come from funds linked to disgraced Malaysian financier Jho Low,” who was the operator and key intermediary for 1MDB.

The donation was, reportedly, made in December 2017 by Larry Davis, co-owner of the Hawaii-based investment company LNS Capital, as part of a campaign to re-elect Trump in 2020. The Department of Justice “is trying to establish whether $1.5 million transferred to LNS Capital seven months earlier by Low were used to finance the donation.”