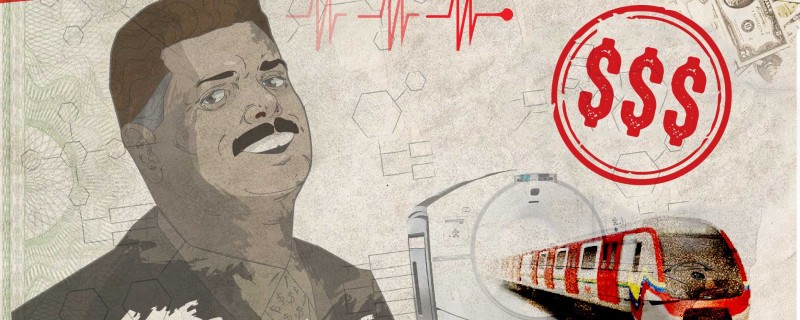

The late Venezuelan President Hugo Chávez called him “the Invisible.”

For most of his long career, Carlos Luis Aguilera Borjas remained mostly in the shadows. The former bodyguard of Venezuelan leader Hugo Chávez rose through various government positions to become director of the country’s secret service in 2001 while avoiding interviews, seldom being photographed, and leaving his private affairs a mystery.

Just over a year later, he disappeared from public service. But even as the Chavista government made a noisy show of condemning capitalism, Aguilera spent his post-government life quietly amassing a fortune. He participated in businesses in Venezuela and abroad that tapped into lucrative government contracts, registered companies in tax havens, opened an account in a Swiss bank, and took frequent trips via chartered jet.

One Swiss bank official valued Aguilera’s fortune in 2013 at US$ 100 million.

How Aguilera accumulated his wealth was revealed in The Switzerland Connection, an investigation published last May by Venezuelan publications Runrun.es, El Pitazo, and Armando Info and Spain’s El Confidencial newspaper.

Based on internal documents from Compagnie Bancaire Helvétique (CBH), a Swiss bank used by Aguilera, as well as a report by Spain’s anti-money-laundering service, SEPBLAC, reporters found that he was part of a network of insiders who built fortunes during the Chávez years and during the administration of his successor, President Nicolás Maduro.

This investigation, published by the Organized Crime and Corruption Reporting Project (OCCRP) in collaboration with Venezuelan parter Runrun.es, builds on these earlier Spanish-language publications.

In 2015, Aguilera and several other former Chavista officials were reported to be under investigation for money laundering in Spain, according to Spanish newspapers.

Aguilera, 57, left public service more than 15 years ago, and his lawyer Edilberto Galán Parrilla denies he is under investigation in Spain. Galán also said that his client seldom travels to Venezuela and has no relationship with the country’s current government.

A representative of CBH said that the bank follows all Swiss banking secrecy laws and regulations and that, due to client confidentiality, it could not respond to specific questions about account holders.

A Long Stretch Near the Top

Aguilera connected with Chávez in 1992, when, as an army officer, he joined his attempted military coup against then-President Carlos Andrés Pérez. By the time Chávez won the presidency in 1998, Aguilera was one of his bodyguards.

He went on to hold a number of government positions in the late 1990s and early 2000s: Director of Presidential Relations, Vice Minister of Communication Management, Secretary of the President’s Office, and president of Venezuela’s pension fund. By 2001, he was head of the country’s intelligence agency.

He left public service around 2003 and the army at about the same time, apparently in order to turn his full attention to business.

The Swiss bank documents and Spanish money laundering report indicate that he developed two main streams of income: contracts with the Venezuelan government for work on the Caracas Metro and a business importing medical supplies that profited from the country’s unique currency controls.

Money in the Metro

In 2007, just three years after leaving the army, Aguilera became the main shareholder of Inversiones Dirca S.A., a Venezuelan company that had been dormant since it was founded seven years earlier. The following year, Dirca secured a major contract for several Spanish companies that it represented to renovate a line of the Caracas metro.

The four-line system in the Venezuelan capital, praised for its cleanliness and efficiency after opening in the early 1980s, has since deteriorated, and the project has been dogged by scandal.

The same French company that built the metro in the 1980s was interested in a contract to renovate the system’s Line 1. But instead, the $1.85 billion job was awarded to Aguilera’s Spanish partners with no public bidding process.

When the contract was later examined by the General Comptroller’s office, it was determined that a public bid should have been solicited because of its size. But there is no sign that the investigation went any further.

Aguilera received a 4.8 percent commission on the contract, worth almost $90 million, through one of his companies. And, though the work was supposed to have been completed in four years, Transparencia Venezuela, the local chapter of Transparency International, says it was not finished as of December. It has been more than 10 years.

Meanwhile, the metro's performance has only continued to deteriorate (See: Caracas' Once-Stellar Metro Struggles to Keep Going).

In response to reporters’ questions about this project, Aguilera's lawyer said that the other bidders for the Line 1 contract “didn’t meet the requirements,” and that his offer had been the cheapest.

The details of Aguilera’s connection to Inversiones Dirca can be gleaned from several internal memos leaked from CBH, a Swiss bank where he set up an account in 2011. The memos were written as part of its due diligence check on Aguilera as a new client.

A Company with Losses and Bills in the Millions

The company was founded by a Venezuelan, Ramón Elvidio Pérez Parra, in Caracas in 2000. Aguilera acquired 70 percent of its shares in 2007 for just 70 million bolivars (about $32,600 at the official rate) and became its vice president that year. A CBH memo shows that he held 65 percent of the company in 2013. (It is unclear whether the discrepancy is an error or reflects real changes in his holdings.)

The memos note that Aguilera and Perez are the company’s “only shareholders” and that the bank has known both men “for many years.”

They describe Aguilera as “a quality client who represents no increased risk to the bank.” The bank also states that, as of 2014, he should no longer be considered a politically exposed person, or PEP. Banks must give extra scrutiny to PEPs who are considered at higher risk to be involved in bribery, money laundering, or embezzlement. The memo gives no reason for this proposed change.

One CBH memo from May 2012 provides further detail on the operations of Inversiones Dirca. It discloses, for example, that Aguilera and Pérez Parra were intermediaries in negotiations between the Spanish companies and Venezuelan authorities.

The memo states that these contracts were worth “several hundreds of millions of euros.”

The bank documents spell out that Inversiones Dirca receives payments from the Spanish firms “as part of the work done in Venezuela.” It clarifies that these funds are then directly transferred to the accounts of the two shareholders.

This information tracks with bank activities disclosed by the Spanish money laundering report, published by the Spanish newspaper El Pais in 2015. According to the SEPBLAC report, in August 2013, Aguilera “received one payment of €600,000 to his account at Banco de Madrid coming from Switzerland.”

Aguilera the Importer

In addition to brokering contracts for the Caracas Metro, Aguilera became a shareholder in a Venezuelan company that benefited from the country’s unique system of currency controls — and appears to have done so while bypassing the required public tender process.

In 2003, Chávez instituted complex financial controls in an effort to stop money from pouring out of Venezuela in the wake of a general strike. This exchange control mechanism has undergone changes over time, but is still in place. It sets an official exchange rate between the US dollar and Venezuelan bolivar that is far below black market prices. (See: Hacking Through Venezuela’s Thick Foreign Exchange Jungle)

These cheap dollars are meant to be available only to importers who obtain government permission to bring in vital goods using the favorable official exchange rates. Instead, the system has allowed corrupt businessmen, politicians, and officials to rack up millions, often by overstating the value of the imported goods or sometimes not importing anything at all. The proceeds were often hidden in shell companies to conceal their true owners.

The best rates went to companies that imported food or medicine. On June 12, 2006, a company called NetMedical was registered in Caracas to import medical and surgical supplies with an initial share capital of 1 million bolivars (then $466).

Crucially, the company has a direct line to a major source of government money: Its file in the National Registry of Contractors shows that its main customer was the Venezuelan Institute of Social Security (IVSS). The massive state enterprise is designed to provide health, retirement, unemployment, and other benefits to mothers, the elderly and other groups.

NetMedical also benefited from the exchange control mechanism. Between 2004 and 2012, the Commission for the Administration of Foreign Exchange granted the company nearly $35 million at a preferential rate for the import of supplies. According to Importgenius, a site that tracks import and export activities at various shipping docks, NetMedical bought medical surgical equipment and other items for just over $30.4 million between 2009 and 2013.

Reporters were unable to find any records showing that legally required bid procedures were followed. A CBH memo also notes that the company’s extensive network of offshore subsidiaries helped it “obtain better results in Venezuelan public tenders.”

As in the case of Dirca, Aguilera joined NetMedical some years after it was founded, buying 25 percent of its shares in May 2012. (A CBH memo shows that Aguilera held 33 percent of the company in June 2013. It is uncertain whether the discrepancy is an error or reflects real changes in his holdings.)

A CBH memo dated Sept. 4, 2012 summarizes the company's operations and describes Aguilera as a “former advisor of the President [Chávez] who converted to lobbying.” (Aguliera’s lawyer denied this, saying that he was “never anyone’s lobbyist.”)

According to the memo, the firm was set up by a man named Eduardo Salzberger with the help of his father, the representative of the Cessna group in Venezuela and other Latin American countries. But the depiction of Salzberger as a founder is puzzling. His name does not appear in Venezuela’s National Registry of Contractors as a NetMedical shareholder along with Aguilera and Alvarez. Other records indicate he directs a company of the same name based in Panama.

The memo says that NetMedical imports medical supplies and hospital equipment in the private sector, but that most of its purchase orders come from public institutions, thanks to Chávez, who “has allowed a tremendous increase in health in Venezuela by allowing the poorest (80 percent of the total population) to have access to health care.”

NetMedical, the document says, evolved from a distributor to a representative of major brands from the US, Europe and, more recently, from the Middle East and Asia. To this end, the firm has “many offshore companies at [its] disposal, which [it has] set up in every one of these geographical zones and which distribute the different equipment to Social Security, the Ministry of Health and other hospitals and doctors of Venezuela.”

The memo also notes that the firm distributes medical supplies to Mexico, Colombia, and the Dominican Republic. This network of associated companies allows it to “get more results in Venezuelan public calls for tenders.”

In 2014, NetMedical expanded in a new direction. It took on the import of food, liquors, wine and alcoholic drinks, as well as cosmetic and home cleaning products. Its capital reached 10 million bolivars in 2016.

The Captain Takes to the Skies

Publication of the Paradise Papers late last year turned up an interesting nugget: An airline charter company called Jetcar V Inc. was set up in Barbados in 2010 with Aguilera named as a director. It used the same Caracas address as NetMedical.

According to the Registrar of Companies of the eastern Caribbean island, the company is dedicated to leasing aircraft.

The Paradise Papers

Based on the number of flights he took, Aguilera may have been his own best customer.

Between September 2005, and July 2017, he left Venezuela 126 times, averaging three to four trips annually in the early years and a record 21 trips in 2015, according to the Administrative Service of Identification, Migration and Aliens (SAIME), which issues passports and tracks migration. Of those flights, a majority — 83 flights, all taking place after September 2009 — were chartered.

His destinations included Oranjestad, Aruba (48 times); Madrid, Spain (29 times); La Romana, Dominican Republic (19 times); and Panama City, Panama (six times).

Other Countries, Other Companies

Records show that Aguilera’s name appears in several firms registered in Venezuela, Panama, Barbados and Spain. In the latter country, he was the representative of CLAB Consultora Inmobiliaria (Real Estate Consultants), established on Nov. 5, 2007 (CLAB represents his initials, Carlos Luis Aguilera Borjas).

The firm is located in Madrid. It had a share capital of €1,773,256 and its rental income reached 28,000 euros in fiscal year 2015, according to the Madrid Mercantile Registry. The reported amount seems low, given the magnitude of its real estate investments in 2015.

Since it was created 11 years ago, the realtor spent €1,715,250 to buy seven assets: one apartment in Madrid; two in La Coruña, a port city and tourism destination in northwest Spain; two parking spaces and two bicycle rooms.

Aguilera’s son, José Manuel Aguilera Rioboo, became an administrator of CLAB Consultora Inmobiliaria in January 2015. He has a Spanish identity card and has worked in other business enterprises in which his father held shares.

The younger Aguilera’s Linkedin page shows that he was a technical manager at NetMedical in 2012-2013 and a technical assistant of the Spanish consortium CSM from June 2009 to July 2011. This is the group that used Inversiones Dirca to obtain contracts to rehabilitate Line 1 of the Caracas Metro.