The leak, which surfaced online in a zip folder in November, revealed a network in which thousands of young women, mostly from outside China’s major cities, received loans of between 2,000 and 6,000 yuan (US$ 290.73 to $872.19) at interest rates as high as 15 percent a week, local media reported. So far, images of at least 167 women have emerged.

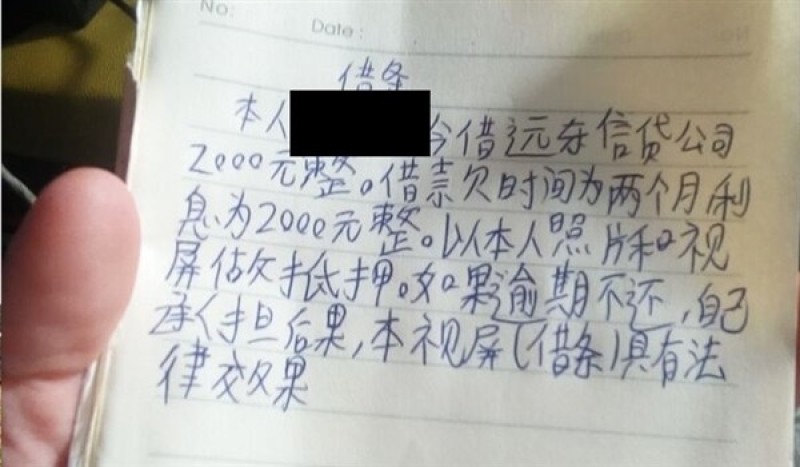

The women typically sent loan sharks images in which they held identities cards and notes explaining the terms of their loans. Some also promised more explicit images or sexual services in the event of non-payment.

"I (name redacted) owe the Far East Credit Company 2,000 yuan. The interest for two months will be double the initial amount of the loan. My photos and videos will be collateral. If the loan is not repaid, this IOU photo will be legally binding," one of the notes reads.

On average, the loans were expected to be repaid within two to four weeks.

The women fell victim to lenders using Jiedaibao, an online peer-to-peer lending platform that requires borrowers to log their identities – but allows borrowers to remain anonymous. The offering of nudes for loans on Jiedaibao had been reported as early as the middle of this year.

The use of public humiliation, as well as violence, is a common tactic by China’s loan sharks, who have long thrived in a country where legitimate sources of credit are hard to come by.

China’s "shadow credit" industry is massive, with the International Monetary Fund estimating the size of the sector at the equivalent of about $6.4 trillion in 2015, about half of that in the form of "elevated risk" loans.

China’s nearly 2,600 peer-to-peer lending platforms handled about $150 billion last year, Agence France-Presse reported.