The European Public Prosecutor’s Office (EPPO) said in a statement that the fraud ring is believed to have caused damages of up to 310 million euros (US$335.98 million) in evaded tax and custom duties.

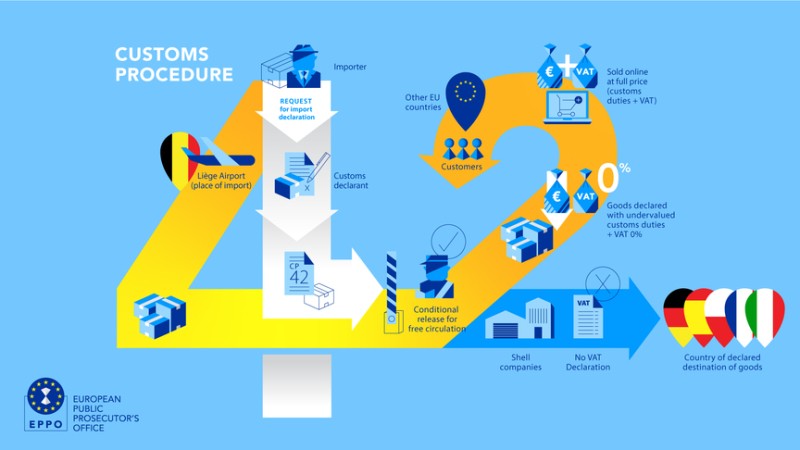

The Chinese exporters acted through three Belgian private customs companies and a number of bogus firms in different EU countries.

During the operation dubbed ‘Silk Road’, the EPPO, supported by Europol and Belgian law enforcement, conducted ten searches at the Liège Airport and in Zeebrugge, Ans, Liège and Visé. Officers arrested four people – two directors, one accountant and another employee of the Belgian companies under investigation.

The EPPO said that certain evidence and assets, including several vehicles, were seized, while a dozen bank accounts were frozen.

The European Prosecutor also specified that the investigation focused on crimes including forgery, customs and VAT fraud, money laundering and participation in a criminal organization.

The fraudster companies “are believed to have used shell companies located in France, Germany, Hungary, Italy, Poland and Spain,” and fake invoices and falsified transport documents, according to the EPPO.

They reportedly exploited the names of legitimate firms in some situations, which were unaware that their VAT numbers and identities had been misused.

“In reality, the shell companies would not receive the goods, which were actually supplied to real companies established in other EU member states, or sold to final consumers via online marketplaces in several countries,” read the statement.

It added that the shell companies were actually created to divert inspectors’ attention by establishing a fictitious commercial chain and making it more difficult to conduct checks.

“The goods would ultimately be sold to the final consumer, who would pay full price for the products, including VAT… but, the VAT paid by the final consumer was never declared nor paid to any tax administration by the alleged criminal organization, and was instead kept by the seller,” the investigation showed.

This would allow the commodities to be sold at a huge profit while evading customs and VAT collecting officials.